What is Palmer Finance?

Palmer Finance, a name that has recently gained attention in the financial world, raises significant concerns about its legitimacy. Traders and investors alike are questioning the credibility of this platform. Before diving into the details, let’s first understand what Palmer Finance claims to be.

Palmer Finance presents itself as an online brokerage firm, offering a range of financial instruments for trading, including stocks, cryptocurrencies, forex, and commodities. The platform boasts an intuitive interface, advanced trading tools, and attractive profit potential. However, these promises are not uncommon in the financial industry, and the real test lies in the execution.

Palmer Finance Details

Regulated by: | Unregulated Offshore Broker |

Is This Company Safe? | The absence of licenses makes any site unsafe! |

Known Websites: | https://palmerfinancecompany.com |

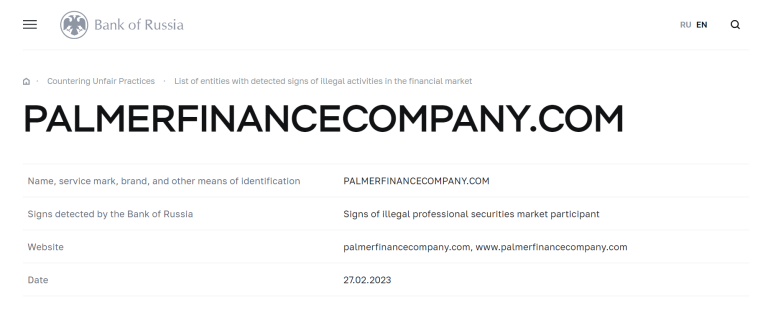

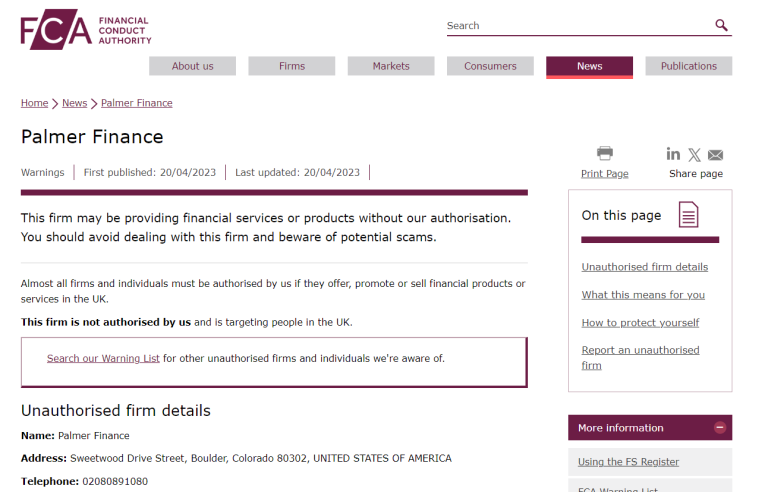

Have Warnings from: | FCA, Bank of Russia |

Registered in: | US (allegedly) |

Operating since: | 2023 |

Trading Platforms: | WebTrader |

Maximum Leverage: | 1:400 |

Minimum Deposit: | 100 GBP |

Deposit Bonus: | Not available |

Trading Assets: | Forex, Commodities, Indices, Crypto, Equities |

Free Demo Account: | Not available |

How to Withdraw from This Company? | Payouts do not happen – better contact our legal services for help! |

Deposits and Withdrawals

One of the first aspects investors consider when assessing a brokerage is the ease of deposits and withdrawals. Palmer Finance allows deposits in multiple currencies, including USD, EUR, and GBP. However, concerns arise when users attempt to withdraw funds. Numerous reports suggest delays and difficulties in the withdrawal process. Some traders claim that their withdrawal requests have been pending for an unusually long time, casting doubt on the platform’s transparency and efficiency.

Account Types

Let’s take a look at Palmer Finance’s different trading accounts:

- Beginner – 100 GBP, 9 major currencies;

- Silver – 5,000 GBP, 2 types of assets, more than 50 instruments;

- VIP – 20,000 GBP, 3 types of assets, more than 200 instruments;

- Gold – 100,000 GBP, 4 types of assets, 250+ tools, 50% bonus;

- Platinum – 200,000 GBP, 4 types of assets, 300+ instruments, 70% bonus;

Leverage offers have a 1:400 maximum. Given that the maximum allowable leverage for retail clients in the US is 1:50, this is evidence that Palmer Finance is not a legitimate US broker.

Bonuses are also provided by the corporation, but there are restrictions. “Traders must buy or sell at least (10) Ten mini lots in real-money mode for each unit of $10 bonus granted by Palmer Finance before submitting any withdrawal requests,” the Terms and Conditions state.

Red Flags and Warning Signs

Several red flags and warning signs surround Palmer Finance, contributing to the skepticism surrounding its legitimacy. Sure, and we’re able to demonstrate it. Let’s disprove this corporate rule first. This fraudulent website left a US address but failed to identify the entity that owns the firm.

That was where we started; to find out if Palmer Finance was legitimate, we looked through the US National Futures Association (NFA) database. The broker was not listed in the NFA’s registry, which is not surprising.

Every legitimate broker with a US address needs to be registered with the CFTC and NFA. Regarding European brokers, the European Securities and Markets Authority (ESMA) is required to regulate all firms. Palmer Finance has been banned instead of being regulated or registered.

Customer Complaints and Negative Reviews

A quick online search reveals a multitude of customer complaints and negative reviews about Palmer Finance. Common grievances include withdrawal issues, unresponsive customer support, and unexpected fees. Traders have reported difficulties in reaching the support team and resolving issues related to their accounts. Furthermore, some users have expressed frustration with the platform’s performance, citing technical glitches and trade execution problems.

Palmer Finance Alternative Brokers

For those who have become wary of Palmer Finance or are actively seeking more reliable alternatives, there are reputable brokers in the market. Some well-regulated and established brokers include eToro, Interactive Brokers, and IG. These platforms have a track record of transparent operations, robust customer support, and adherence to regulatory standards.

Got Scammed by Palmer Finance? We Help Victims!

If you find yourself a victim of a scam or fraudulent activities on the Palmer Finance platform, it’s crucial to take immediate action. Contact your bank or payment provider to report the issue and seek assistance in recovering funds. Additionally, consider reporting the incident to relevant financial authorities and regulatory bodies. It’s essential to raise awareness about such scams to protect others from falling victim to similar schemes.

In conclusion, the legitimacy of Palmer Finance comes into question due to various red flags, customer complaints, and the absence of regulatory oversight. Traders and investors should exercise caution and conduct thorough research before engaging with any online brokerage. Choosing a reputable and regulated broker ensures a safer trading environment and helps protect investments from potential scams.