Is Munro Financial Planners Limited Legit or a Scam?

Munro Financial Planners Limited is a scam broker. They have several issues like registration issues, withdrawal problems, etc. If you want to invest with this broker, you should read this full review.

What is Munro Financial Planners Limited?

Munro Financial Planners Limited claims to be a reputable brokerage firm, offering a range of financial services and investment opportunities. However, a closer look raises significant concerns about the legitimacy of this platform.

Munro Financial Planners Limited Details

Regulated by: | Unregulated Offshore Broker |

Is This Company Safe? | The absence of licenses makes any site unsafe! |

Known Websites: | Munrofinancialplannersltd.com Munrofinancialplannersltd.net |

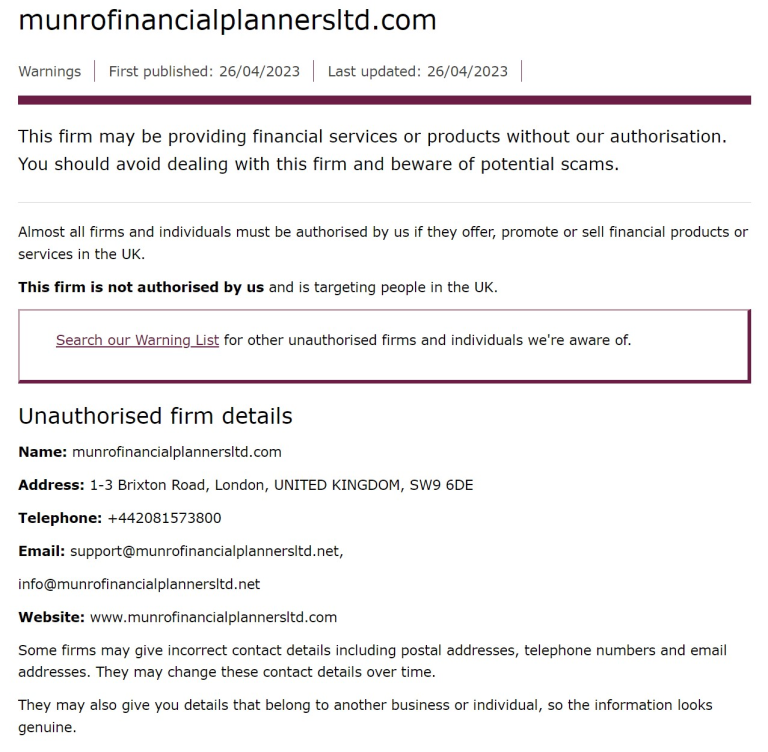

Have Warnings from: | FCA |

Registered in: | UK (allegedly) |

Operating since: | 2022 |

Trading Platforms: | WebTrader |

Maximum Leverage: | 1:100 |

Minimum Deposit: | $100 |

Deposit Bonus: | Not available |

Trading Assets: | Forex, Indices, Shares, Futures, Crypto, Metals, Energies |

Free Demo Account: | Not available |

How to Withdraw from This Company? | Payouts do not happen – better contact our legal services for help! |

Deposits and Withdrawals

One of the crucial aspects to consider when evaluating a brokerage firm is the ease and security of deposits and withdrawals. Munro Financial Planners Limited, however, has raised several red flags in this regard. Numerous users have reported difficulties in withdrawing their funds, with a lack of transparency and responsiveness from the platform’s support team. Some victims have even alleged unauthorized transactions and fund mismanagement.

Account Types

Munro Financial Planners Limited advertises various account types, each supposedly tailored to meet different trading needs.

- Beginner – 100 GBP

- Silver – 5,000 GBP

- Gold – 10,000 GBP

- Platinum – 50,000+ GBP

Less commissions, more daily signals, and increased leverage are all benefits of larger account levels. We are unable to verify it, therefore you will have to take the broker’s word for it.

Red Flags and Warning Signs

Munro Financial Planners has updated their website with a UK address and company number. Munro Financial Planners Limited was the company we discovered after looking up the number in the Companies House record. But this business was established in 2012, and as of right now, it is actively seeking to strike off. Furthermore, they will shortly close because their statements are past due.

In April 2023, Munro Financial Planners and its website, munrofinancialplannersltd.com, were placed on the FCA warnings list. The regulatory statement indicates that this company might be offering financial services or goods without FCA approval.

Customer Complaints and Negative Reviews

A deeper dive into online forums and customer reviews reveals a concerning pattern of complaints against Munro Financial Planners Limited. Users have reported issues ranging from withdrawal problems to unauthorized transactions and unresponsive customer support. The consistency and nature of these complaints raise serious doubts about the integrity of this brokerage.

For those who have fallen victim to Munro Financial Planners Limited, there is a pressing need for action. However, resolving issues with an unregulated and potentially fraudulent broker can be challenging. Victims often find themselves in a frustrating situation, grappling with financial losses and a lack of recourse.

Munro Financial Planners Limited Alternative Brokers

If you have encountered issues with Munro Financial Planners Limited, it is advisable to discontinue any further engagement with the platform. Seeking assistance from reputable and regulated brokers is crucial for safeguarding your investments. Some alternative brokers with a track record of reliability include eToro, Interactive Brokers, and IG.

Got Scammed by Munro Financial Planners Limited? We Help Victims!

If you are a victim of the Munro Financial Planners Limited scam, you are not alone. Many individuals have faced similar challenges, and there are resources available to assist you. Reporting the incident to relevant financial authorities can help raise awareness and potentially initiate investigations into the activities of this dubious broker.

Additionally, seeking legal advice is essential for exploring potential avenues for recovering your funds. There are organizations and legal professionals dedicated to assisting victims of financial scams, offering guidance on steps to take and resources to tap into for restitution.

In conclusion, Munro Financial Planners Limited exhibits several characteristics indicative of a potential scam. From regulatory concerns to customer complaints, the evidence suggests that investors should approach this platform with extreme caution. Choosing reputable and regulated brokers is crucial for protecting your investments and ensuring a secure and transparent trading experience.