Is U Capital Legit or a Scam?

Investors entering the financial markets are often faced with the daunting task of choosing a reliable broker. U Capital, a name that has garnered attention in the trading community, prompts the crucial question: Is U Capital a legitimate platform or a potential scam? As we delve into the details, various aspects of U Capital’s operations will be scrutinized to provide a comprehensive understanding of its credibility.

What is U Capital?

U Capital presents itself as an online trading platform, offering a range of financial instruments for traders to engage with. The platform claims to provide cutting-edge technology, user-friendly interfaces, and a variety of account types to cater to diverse trading preferences.

U Capital Details

Regulated by: | Unregulated Offshore Broker |

Is This Company Safe? | The absence of licenses makes any site unsafe! |

Known Websites: | https://ucapitals.com/ |

Have Warnings from: | N/A |

Registered in: | Marshall Islands (alleged) |

Operating since: | 2020 |

Trading Platforms: | N/A |

Maximum Leverage: | N/A |

Minimum Deposit: | N/A |

Deposit Bonus: | Not available |

Trading Assets: | Forex, Indices, Shares, Futures, Crypto, Metals, Energies |

Free Demo Account: | Not available |

How to Withdraw from This Company? | Payouts do not happen – better contact our legal services for help! |

Deposits and Withdrawals

One critical aspect of any trading platform is its deposit and withdrawal procedures. U Capital requires a minimum deposit of $250 to initiate trading. While this figure is standard in the industry, concerns arise when considering the lack of regulation. Traders are advised to exercise caution when depositing funds into unregulated platforms, as the absence of oversight may lead to potential risks.

Withdrawal processes with U Capital have been reported to be sluggish and accompanied by complex terms and conditions. This raises questions about the transparency of the broker and the ease with which clients can access their funds.

Account Types

U Capital offers a range of account types to cater to traders with varying experience levels and preferences. They are different in terms of features, including leverage, spreads, and additional services. However, the lack of regulatory oversight calls into question the fairness and transparency of these account differentiations.

Red Flags and Warning Signs

A closer examination of U Capital reveals several red flags that potential investors should consider. Firstly, the broker operates without regulation, leaving traders unprotected in the event of disputes or malpractices. Regulated brokers adhere to stringent guidelines, providing a safety net for investors.

Moreover, the lack of clarity on U Capital’s ownership and management is a cause for concern. Legitimate brokers are transparent about their leadership, fostering trust among their client base. The absence of such information with U Capital raises suspicions about its intentions and commitment to ethical business practices.

Customer Complaints and Negative Reviews

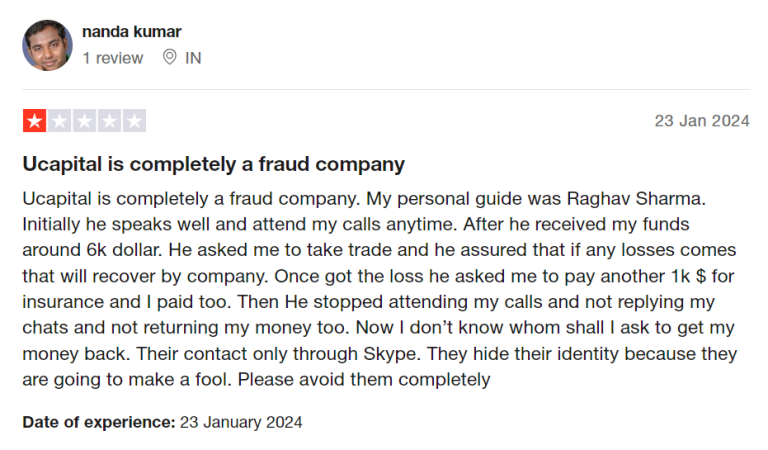

The internet is rife with customer complaints and negative reviews about U Capital. Traders have reported difficulties in withdrawing funds, sudden account closures, and unresponsive customer support. These grievances, coupled with the absence of regulatory oversight, paint a concerning picture of U Capital’s operations.

Got Scammed by U Capital? We Help Victims!

If you find yourself a victim of U Capital’s alleged malpractices, it is crucial to take action promptly. Seek assistance from regulatory bodies and financial authorities, providing them with detailed information about your experience. Additionally, consider contacting legal professionals specializing in financial fraud to explore potential avenues for restitution.

In conclusion, the question of whether U Capital is a legitimate platform or a scam remains a pressing concern for traders. The lack of regulation, coupled with red flags and numerous negative reviews, raises significant doubts about the broker’s credibility. Traders are urged to exercise caution and explore alternative, regulated options to safeguard their investments and mitigate potential risks.

If you’ve experienced financial losses with companies like Venus4T, HeroFX, or FameEX, please report it using the form below.