Is SAM Trade Legit or a Scam?

No. You discover the broker is not at all legitimate after receiving a warning from the authorities and reading numerous unfavorable reviews.

What is SAM Trade?

SAM Trade has been making waves in the financial market, claiming to offer a cutting-edge trading platform with lucrative opportunities for investors. However, as with any promising venture, it is crucial to scrutinize the legitimacy of such platforms before diving in. In this review, we will delve into the details of SAM Trade, exploring its features, user experiences, and the alarming signs that could suggest a potential scam.

SAM Trade Details

Before we analyze SAM Trade’s legitimacy, let’s take a closer look at the broker’s details

Broker status: | Unregulated |

Regulated by: | No regulations |

Operating Status: | Active trading scam |

Known Websites: | samtradefx.com, samtradefx.com.au |

Blacklisted by: | MAS Singapore |

Owner: | S.A.M Financial Group |

Headquarters Country: | St. Vincent and Gradines, Australia |

Foundation Year: | 2015 |

Online Trading Platforms: | MT4 |

Mobile Trading: | Available |

Minimum Deposit: | $10 |

Deposit Bonus: | N/A |

CFD Trading Option: | Yes |

Crypto Asset Trading: | Yes – BTC, XRM, DOT |

Available Trading Instruments: | Forex, Commodities, Indices, Crypto, Futures |

Maximum Leverage: | 1:1000 |

Islamic Account: | Available |

Free Demo Account: | Yes |

Accepts US clients: | US clients are accepted |

Global Fraud Protection Experts’ Verdict: | Considering lost licenses, closed investigation, and 3 people arrested, you should have enough signs to avoid this broker. |

Deposits and Withdrawals

One of the primary concerns for any trader is the ease of deposits and withdrawals. SAM Trade presents itself as a user-friendly platform, but user experiences suggest otherwise. Many traders have reported significant delays in processing withdrawals, with some complaining about unexplained deductions from their accounts. Such issues raise red flags and warrant caution.

Account Types

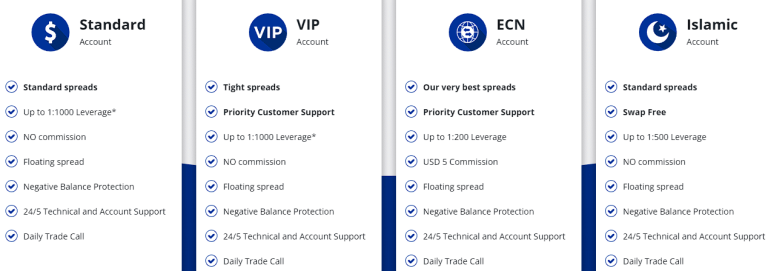

The whole foundation of the Samtrade FX fraud is your deposits. You have many account kinds as a result, which encourage traders to make larger deposits. Those in this instance are:

- Standard

- VIP

- ECN

- Islamic (with an offshore entity)

Red Flags and Warning Signs

First off, SAM Trade Company is global in its operations. You therefore anticipate that they will own reliable Tier 1 licenses, including CFTC, ASIC, BaFIN, or FCA. This company did, in fact, hold an ASIC license, however it was shut down in 2022. Additionally, their Canadian FINTRAC license expired. However, the business still displays those statistics on its website with pride.

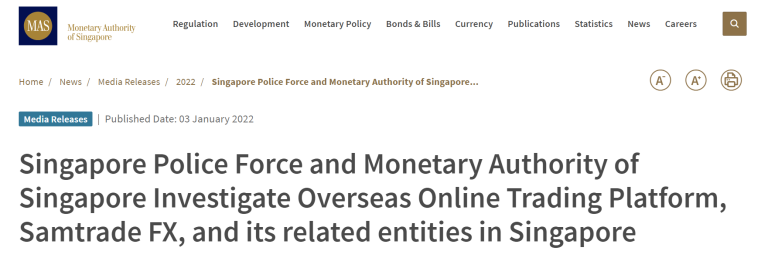

Fortunately, Singapore MAS looked into this broker and made three arrests in the process. Check out the warning that is available to the public.

Customer Complaints and Negative Reviews

A quick search on online forums and review websites reveals a slew of negative feedback and complaints from SAM Trade users. Common issues include difficulties in withdrawing funds, unresponsive customer support, and unexpected account closures. Traders have expressed frustration and concern about the platform’s legitimacy, urging others to exercise caution.

Got Scammed by SAM Trade? We Help Victims!

If you’ve fallen victim to SAM Trade’s dubious practices, you’re not alone. Our mission is to assist victims of scams, providing guidance on reporting the incident, seeking legal advice, and recovering lost funds. Contact us to share your story and learn about the steps you can take to navigate the aftermath of a scam.

In conclusion, SAM Trade raises several red flags that cast doubt on its legitimacy as a reliable broker. Traders are advised to exercise caution and consider alternative brokers with established credibility. If you’ve encountered issues with SAM Trade, don’t hesitate to reach out for support and explore avenues to recover your losses.

If you’ve experienced financial losses with companies like FxWinning, HeroFX, or FameEX, please report it using the form below.