Is AAG Markets Legit or a Scam?

Steer clear of AAG Markets if you value your financial security. This unregulated broker, operating under the trading name AAG Ltd., boasts of generous leverage and enticing account types, but beneath the surface lies a web of red flags and customer complaints that scream “scam.”

What is AAG Markets?

AAG Markets presents itself as an STP (Straight Through Processing) forex broker, promising tight spreads, access to various financial instruments, and the popular MetaTrader4 platform. They claim to have been established in 2006 and hail from Saint Vincent and the Grenadines, a notorious haven for shady financial entities.

AAG Markets Details

Regulated by: | Unregulated Investment Scam |

Is This Company Safe? | No |

Known Websites: | |

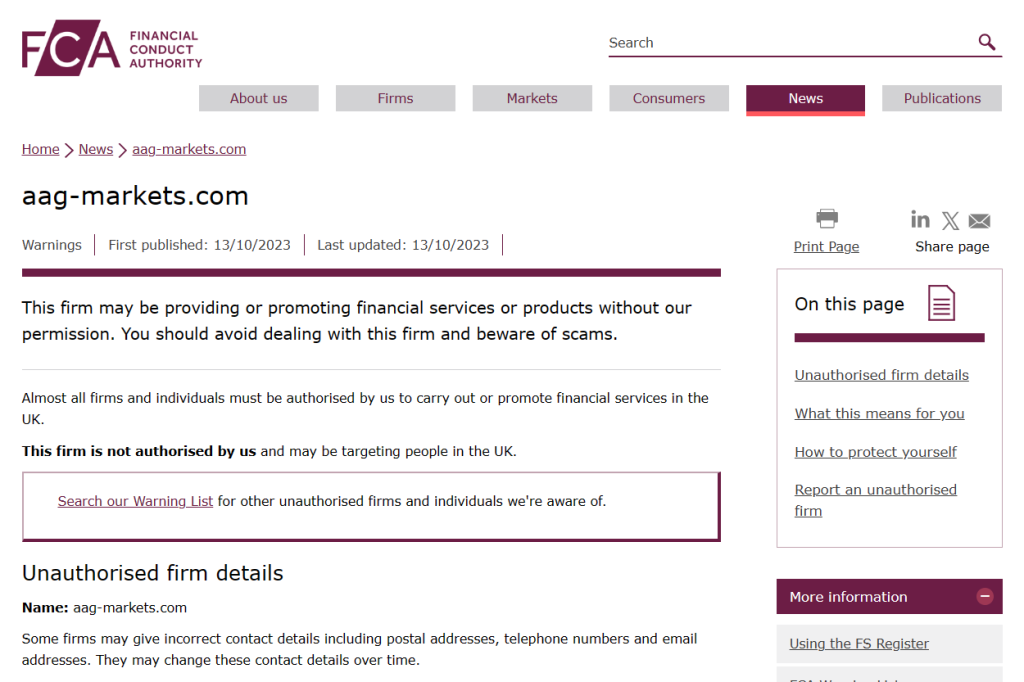

Have Warnings from: | FCA |

Registered in: | UK (allegedly) |

Operating since: | 2023-09-18 |

Trading Platforms: | N/A |

Maximum Leverage: | N/A |

Minimum Deposit: | 50 USD |

Deposit Bonus: | N/A |

Trading Assets: | Forex, Cryptocurrencies |

Free Demo Account: | Unavailable |

How to Withdraw from This Company? | Since this company is unlikely to return your money – contact your bank or financial regulator, or simply reach out to us for professional assistance in recovering your funds. |

Deposits and Withdrawals

AAG Markets accepts a variety of deposit methods, including wire transfers, credit cards, and e-wallets. However, numerous user reports highlight difficulties and delays in withdrawing funds. This is a classic red flag indicative of potential fund trapping.

If you have lost money to companies like Vault Markets, or AlterCoin; please report it to us on our Report a Scam form.

Account Types

Investment Plan | First | Second | Third | Fourth |

Minimum Deposit | 50 USD | 5,000 USD | 10,000 USD | 50,000 USD |

Duration | 2 Days | 4 Days | 6 Days | 8 Days |

Return on Investment | 20% | 30% | 40% | 50% |

Twenty percent return in two days? Only if the company bets with your money and wins can you expect such a phenomenal return, but you are already aware of how dangerous it is and how quickly it could go south. It is impossible to promise such large returns from trading because it is so unpredictable.

Red Flags and Warning Signs

This company (aagmarkets.com) was formerly headquartered in the infamous offshore country of Saint Vincent and the Grenadines, according to some previous AAG Markets assessments. There is a difficulty with the purported transfer of the firm to the United Kingdom.

According to firm House, the firm ID given on the website is really owned by Fixeday Investment Limited, a different organization. Nonetheless, we discovered a regulatory alert against this novel investment plan. It first surfaced on the Financial Conduct Authority (FCA) website in the UK on October 13 of this year.

Consequently, the company is untrustworthy. You “won’t be protected by the Financial Services Compensation Scheme (FSCS) if things go wrong,” according to the inference made by the absence of a license.

Customer Complaints and Negative Reviews

A quick Google search reveals a mountain of negative user experiences with AAG Markets. Common complaints include:

- Withdrawal delays or blocked withdrawals: Customers report being unable to withdraw their funds, with AAG Markets citing various excuses or simply ignoring requests.

- Poor customer support: Contacting AAG Markets for assistance seems to be an exercise in futility, with reports of unresponsive emails, phone lines, and live chat.

- Suspicious trading activity: Some users allege experiencing manipulated spreads, inexplicable stop-loss hunting, and other unfair trading practices.

AAG Markets Alternative Brokers

Instead of risking your hard-earned money with AAG Markets, consider reputable and regulated brokers such as:

- IG: A UK-based broker with a long track record of reliability and FCA regulation.

- CMC Markets: Another FCA-regulated broker offering a wide range of instruments and a user-friendly platform.

- AxiTrader: An Australian ASIC-regulated broker known for its competitive spreads and transparency.

Always prioritize regulatory oversight, transparent fees, and positive customer reviews when choosing a forex broker.

Got Scammed by AAG Markets? We Help Victims!

Unfortunately, recovering funds from unregulated brokers like AAG Markets can be an uphill battle. However, resources and organizations exist to help victims:

- Financial ombudsmen: These independent bodies can investigate your complaint and potentially mediate a resolution.

- Chargeback schemes: Depending on your payment method, you may be able to initiate a chargeback to reclaim your funds.

- Fraud reporting agencies: Report your experience to authorities in your jurisdiction and international anti-fraud organizations.

While the process may be challenging, staying silent only empowers scammers. Speak up, share your story, and help protect others from falling victim to AAG Markets or similar predatory brokers.

Remember, the allure of quick profits with unregulated brokers rarely ends well. Stick to reputable, regulated firms, prioritize transparency, and protect your financial well-being. Don’t let AAG Markets or any other scam broker exploit your hard-earned money or You Can report to us today by the below form.

One Response