This article delves into the disturbing revelations surrounding Rocks Capital, a purported broker that has garnered attention for all the wrong reasons. By shedding light on its deceptive practices, lack of regulatory oversight, and negative client experiences, we aim to protect unsuspecting traders from falling victim to the Rocks Capital scam.

Company Overview

Rocks Capital positions itself as a premier brokerage firm offering a wide array of financial instruments and investment opportunities. However, closer scrutiny reveals a lack of transparency and credibility. They did not mention any founding year, or their location on their website. According to their given phone number, it is clear that they are located in the USA.

Regulatory oversight is critical to safeguarding traders’ interests. However, Rocks Capital fails to provide any evidence of regulatory compliance. The absence of oversight from reputable authorities raises concerns about the potential risks involved in dealing with this unregulated entity.

Pros and Cons

It is imperative to weigh the pros and cons before entering into any financial arrangement. Rocks Capital touts features such as a user-friendly interface, a broad range of trading instruments, and competitive spreads. However, these perceived advantages pale in comparison to the incontrovertible cons, such as lack of regulation, questionable business practices, and a plethora of negative customer experiences.

How Does Rocks Capital Reach Their Prey?

Rocks Capital employs various manipulative tactics to attract unsuspecting traders. Their marketing efforts include aggressive cold calling, unsolicited emails, and flashy advertisements promising lucrative returns on investment. These strategies are aimed at exploiting the vulnerabilities and inexperience of novice traders, ultimately leading them into financial ruin.

Technical Details

While Rocks Capital’s website may appear professional and polished, closer examination reveals several red flags. These include inconsistencies in the provided contact information, lack of company registration details, and substandard SSL encryption to safeguard personal and financial data.

Minimum Deposit:

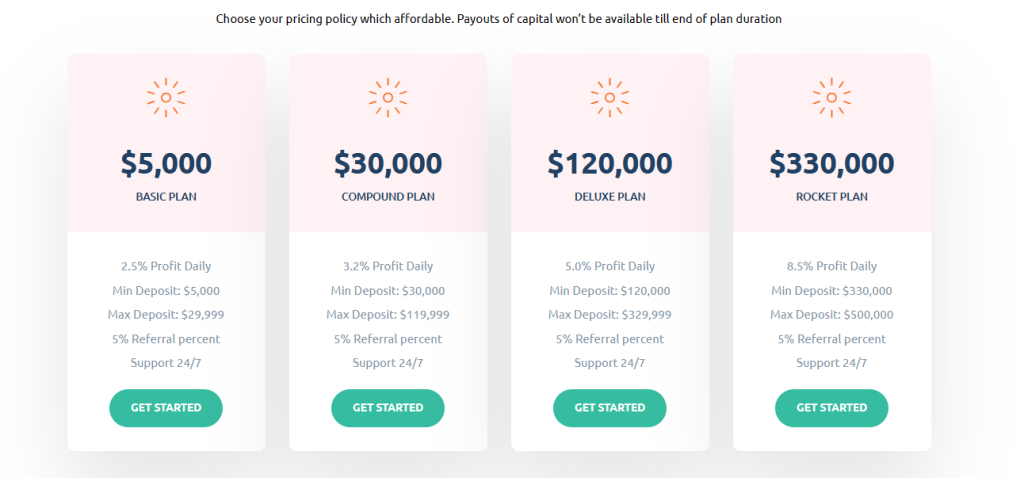

Rocks Capital requires a higher minimum deposit of $5,000 to open an account, a practice commonly associated with scam brokers. The amount demanded far exceeds industry standards and serves as an initial barrier, making it difficult for traders to withdraw their funds if they become suspicious of the company’s legitimacy.

Trading Platform:

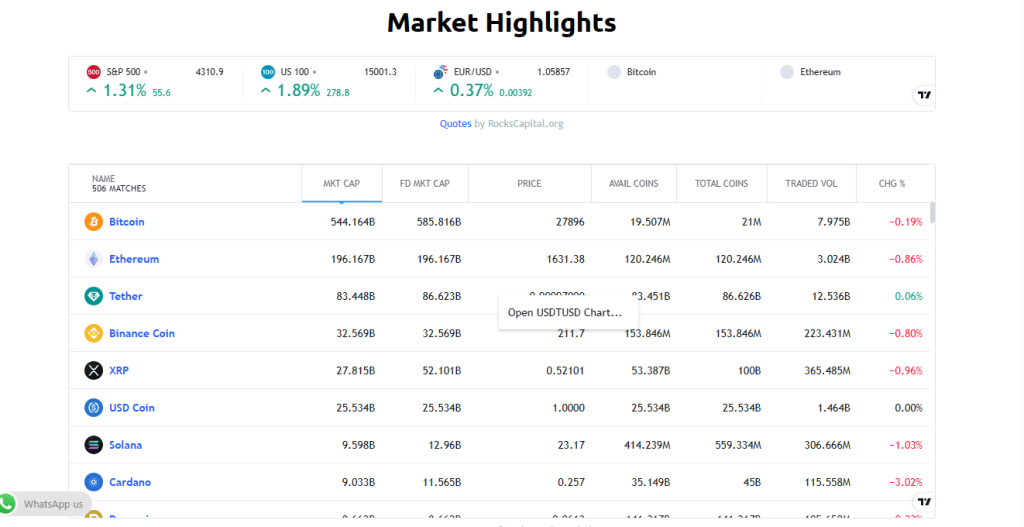

The Rocks Capital trading platform, designed to entice traders, claims to be user-friendly and technologically advanced.

Spread and Leverages:

Rocks Capital lures traders with promises of tight spreads and high leverage, enticing them with the potential for substantial profits. However, the lack of regulation further enhances the risk associated with these offerings, potentially leading to devastating financial consequences.

Packages and Products They Offer

Their packages are quite high price and it seems unreal to engage with these high prices.

Withdrawal and Deposit Method

Numerous client complaints point to significant difficulties encountered when attempting to withdraw funds from Rocks Capital. Lengthy verification processes, excessive withdrawal fees, and unreasonable requirements serve as deterrents, trapping clients within the scam broker’s grasp.

What Do Their Previous Traders Say?

A plethora of negative reviews and testimonials from previous clients shed light on the true nature of Rocks Capital. These accounts highlight issues ranging from withdrawal problems to unexplained closure of accounts, leaving traders distraught and financially devastated.

Summing Up – Why Should You Not Trust Rocks Capital

The evidence presented in this review paints a bleak picture of Rocks Capital’s integrity and trustworthiness. Lack of regulation, numerous client complaints, and manipulative marketing tactics all contribute to a strong case against entrusting your hard-earned funds to this dubious broker.

If Bad Things Happen, Where Can You Get The Quick Solution?

In the unfortunate event of falling victim to Rocks Capital or any other scam broker, it is crucial to seek expert guidance and assistance. Professional recovery services, such as our recommended free consultation and recovery service providers, can help reclaim lost funds and navigate the complex process of recouping losses.

File A Complaint Against Scam Broker's

Final Thoughts

Investing in financial markets can be a rewarding experience if conducted through legitimate and regulated brokers. However, Rocks Capital’s unregulated status, deceptive practices, and negative client experiences present a clear warning to traders seeking reliable brokerage services. By making well-informed decisions, you can protect your investments and avoid falling victim to scams like Rocks Capital.

You Can Read Our Other Scam Reviews

Is Fitch-Finance.online Legit or a Scam Broker?

Are you considering investing with Fitch-Finance? Before you hand over your hard-earned money, it’s crucial to do your research. Here are some red flags suggesting

Is XBTES.cc Legit or a Scam Broker?

This XBTES review dives into the reasons why this broker raises red flags and should be approached with caution. If you’re considering using this broker,

Is Global Crypto Currency Legit or A Scam Broker?

There are several reasons to be cautious about Global Crypto Currency. Here are some red flags: Limited information: A legitimate broker should have a readily

Is Fnx Crypto Assets Legit or A Scam Broker?

There are several reasons to be cautious about Fnx Crypto Assets and consider it a potential scam broker. Here are some red flags: Lack of