Is Elland Road Capital Legit or a Scam?

If you are considering Elland Road Capital as your potential broker, it’s crucial to delve into the intricacies of its operations to determine whether it’s a legitimate platform or a potential scam. In the complex world of online trading, scams are not uncommon, and due diligence is the key to safeguarding your investments.

What is Elland Road Capital?

Elland Road Capital claims to be a leading online trading platform, offering a wide range of financial instruments for investors to trade. From forex and commodities to cryptocurrencies, the platform asserts its commitment to providing a diverse and user-friendly trading experience. However, a closer look is necessary to ascertain the authenticity of these claims.

Elland Road Capital Details

Before delving into the red flags, it’s essential to examine the key details of Elland Road Capital. The table below outlines crucial information about the platform:

Broker Status: | Regulated Broker |

Regulated by: | FSCA |

Known Broker Sites: | ellandroadcapital.com |

Operating Status: | (Alleged) Forex Scam Broker |

Complaints From Regulators: | N/A |

Broker Owner: | Elland Road Capital PTY LTD |

Headquarters Country: | South Africa |

Foundation Year: | 2022 |

Trading Platforms: | MT4, WebTrader |

Mobile Trading: | Available |

Minimum Deposit: | $250 |

Deposit Bonus: | Yes |

Crypto Trading: | Available – BTC, ETH, ADA… (10 in total) |

CFD Trading: | Yes, you can trade CFDs |

Trading Instruments: | Forex, Indices, Commodities, Shares, Crypto |

Maximum Leverage: | 1:400 |

Islamic Account: | Not Available |

Demo Account: | Yes |

Accepts US Clients: | US traders are not accepted |

Deposits and Withdrawals

One of the first areas to scrutinize when evaluating an online broker is its deposit and withdrawal process. Elland Road Capital appears to offer the standard options, including credit/debit cards and bank wire transfers. However, the minimum deposit of $250 raises eyebrows, as reputable brokers often have more reasonable entry points.

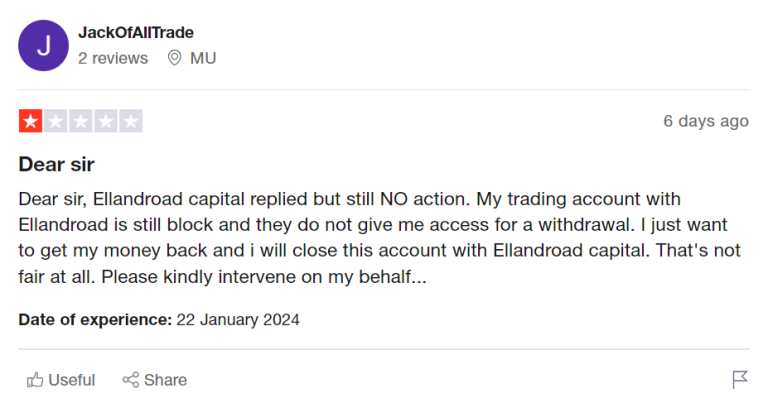

Moreover, numerous user complaints suggest that the withdrawal process with Elland Road Capital is far from seamless. Traders report delays, unresponsive customer support, and, in some instances, an inability to access their funds altogether. These issues are stark warning signs that potential investors should not ignore.

Account Types

Elland Road Capital offers five different account types:

- Classic – 250 $, EUR/USD spread 2.5 pips;

- Silver – EUR/USD spread 2.5 pips;

- Gold – EUR/USD spread 1.8 pips;

- Platinum – EUR/USD spread 1.4 pips;

- VIP – EUR/USD spread 0.9 pips.

What’s suspicious here is that Elland Road Capital didn’t specify the minimum deposit amounts for the accounts. All we know is that the Classic account costs at least 250 $.

The spreads are not competitive at all. As for the leverage, Elland Road Capital’s cap is 1:400, which is extremely high, risky, and well above ESMA’s limit of 1:30. A level that high often leads to devastating losses.

Red Flags and Warning Signs

This business policy is in effect. The broker is governed by the FSCA of South Africa and has been in business since 2022.

But compared to Tier 1 authorities like the FCA, ASIC, CFTC, BaFin, etc., the FSCA is a Tier 2 regulator and is therefore less trustworthy. In South Africa, there are slightly less stringent regulations in place. According to certain evaluations, Elland Road Capital went beyond the parameters of its license.

Any trading forum you visit will have unfavorable comments about this company. Therefore, there’s a compelling argument against this broker. Please consider this information if you decide to trade with this broker still.

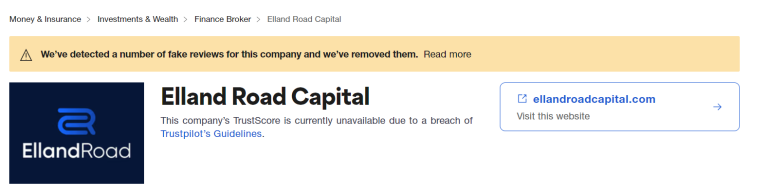

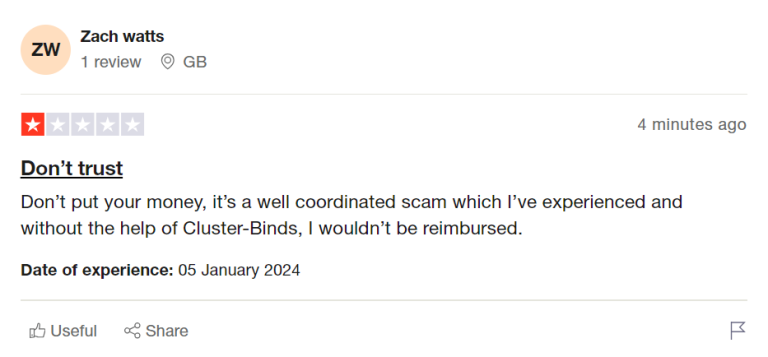

Customer Complaints and Negative Reviews

A quick search online reveals a plethora of negative reviews and complaints from Elland Road Capital users. Common grievances include difficulties in withdrawing funds, poor customer support, and unexpected fees. These complaints serve as a stark warning to potential investors, urging them to exercise caution before entrusting their money to this platform.

Got Scammed by Elland Road Capital? We Help Victims!

If you find yourself a victim of Elland Road Capital’s alleged malpractices, it’s essential to take immediate action. Report the incident to your local financial regulatory authority, and consider seeking legal advice to explore potential avenues for recovery. Additionally, share your experience online to warn others and contribute to the collective effort to expose and prevent fraudulent activities in the online trading industry.

In conclusion, the numerous red flags surrounding Elland Road Capital raise serious concerns about its legitimacy. Traders should approach this platform with caution and, preferably, consider alternative brokers with a more transparent and regulated approach to online trading.

If you’ve experienced financial losses with companies like TranzactCard, HeroFX, or QxBroker, please report it using the form below.