The once-promising FTX, hailed as a cutting-edge cryptocurrency exchange, is now a cautionary tale. In November 2023, the company filed for bankruptcy, leaving a trail of disgruntled customers and unanswered questions. Was FTX a legitimate platform or a meticulously crafted scam? Let’s unravel the truth.

What is FTX?

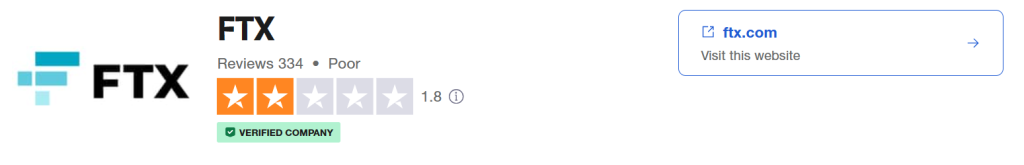

FTX, short for “Futures Exchange,” launched in 2019, offers cryptocurrency derivatives trading. It quickly gained popularity for its sleek interface, advanced trading features, and high-leverage options. However, its allure masked significant regulatory gaps and internal mismanagement.

FTX Details

Regulated by: | Unregulated Offshore Broker |

Is This Company Safe? | The absence of licenses makes any site unsafe! |

Known Websites: | https://ftx.com |

Have Warnings from: | Several organizations |

Registered in: | Bahamas |

Operating since: | 2019 |

Trading Platforms: | WebTrader |

Maximum Leverage: | 1:500 |

Minimum Deposit: | N/A |

Deposit Bonus: | Not available |

Trading Assets: | Forex, Indices, Shares, Futures, Crypto, Metals, Energies |

Free Demo Account: | Not available |

How to Withdraw from This Company? | Payouts do not happen – better contact our legal services for help! |

Deposits and Withdrawals

FTX initially boasted various deposit and withdrawal methods, including fiat currencies and cryptocurrencies. However, as financial woes surfaced, limitations and delays started plaguing the system. Many users reported difficulties withdrawing funds, amplifying fears of a potential exit scam.

If you have lost money to companies like FXpremium, or Bitlerz; please report it to us on our Report a Scam form.

Account Types

FTX offered several account types, each with different trading benefits and fees. However, the lack of transparency surrounding account terms and conditions fueled skepticism about the exchange’s true intentions.

Red Flags and Warning Signs

While its subsidiary, FTX Digital Markets Ltd, is located in the Bahamas, FTX Trading Ltd is based in Antigua and Barbuda. These are the top two companies with the most recent holding regulations issued by the Bahamas Securities Commission.

The Bahamas Supreme Court bowed in and banned all FTX assets kept on this offshore island as soon as US regulators began looking into the entire business.

Additionally, FTX offers services to citizens of Australia via its branch, FTX Express Pty Ltd, a digital currency services provider with an AUSTRAC registration.

The company also holds a Gibraltar Financial Services Commission license through its Zubr Exchange Limited office.

Through K-DNA Financial Services Ltd., a legally established company in Cyprus with CySEC license 273/15, the firm was granted European approval. By collaborating with FTX Switzerland GmbH and FTX Trading GmbH, this business was able to secure a German license and FINOS participation. It is permitted by these organizations to provide tokenized stock trading to EU citizens.

Moreover, FTX was the first broker to receive a license from the Virtual Asset Regulatory Authority (VARA), a recently formed UAE agency that oversees the trading of digital currencies.

After receiving a license in July 2022, its subsidiary DAAG Trading, DMCC, became the first company in the UAE to lawfully offer cryptocurrency services. Binance got the same approval shortly after.

FTX Japan Corporation has received a license from FSA Japan, and OVEX FSP (Proprietary) Limited is the name of the branch that operates in South Africa.

Customer Complaints and Negative Reviews

Numerous negative reviews and complaints paint a grim picture of FTX’s customer service. Users allege:

- Difficulty withdrawing funds: FTX blocked or significantly delayed withdrawals, raising concerns about trapped funds.

- Unresponsive customer support: Frustratingly long wait times and unhelpful responses by customer representatives further erode trust.

- Lack of transparency: FTX remained vague regarding financial operations and system issues, leaving users in the dark.

FTX Alternative Brokers

If you’re looking for a safe and reliable platform for trading cryptocurrencies, consider these alternatives:

- Coinbase: A well-established exchange with a user-friendly interface and strong security measures.

- Kraken: A reputable exchange with a focus on security and regulatory compliance.

- Gemini: A secure exchange with a focus on institutional investors, but also offering services to retail traders.

- Binance: While facing some regulatory scrutiny, Binance remains a popular choice due to its wide range of features and competitive fees.

It’s important to thoroughly research any crypto exchange before investing your hard-earned money. Look for platforms with strong regulatory oversight, robust security measures, and a transparent track record.

Got Scammed by FTX? We Help Victims!

If you’ve fallen victim to FTX’s practices, you’re not alone. Several platforms and communities offer support and guidance for scam victims, including legal resources and recovery options. Don’t hesitate to seek help and pursue any avenues for reclaiming your losses.

FTX’s meteoric rise and tragic fall serve as a stark reminder of the importance of due diligence and cautious engagement in the unregulated world of cryptocurrency. Remember, if it seems too good to be true, it probably is. Choose regulated platforms, prioritize transparency, and exercise caution before entrusting your funds to any exchange. The cryptocurrency market is rife with risk, but by staying informed and vigilant, you can navigate it with a sense of responsibility and protect your financial well-being or You Can report to us today by the below form.

2 Responses