CoinField is not a legitimate broker. Why?

CoinField, boasting itself as the fastest-growing crypto exchange platform, paints a picture of seamless trading and high security. But beneath the polished veneer lies a web of red flags and damning user experiences that paint a different story: one of potential scam tactics and lost investments. Before entrusting your hard-earned money to CoinField, let’s dissect the platform and uncover the truth hiding in the shadows.

What is CoinField?

CoinField is a Canadian-based exchange platform primarily focused on the Canadian market. They offer trading in various cryptocurrencies and boast features like high-security levels, a user-friendly interface, and competitive fees. But does the reality live up to their promises?

CoinField Details

Regulated By: | No Regulations |

Is This Company Safe? | No |

Known Websites: | Coinfield.com |

Have Warnings From: | OSC, CSA |

Registered In: | Estonia, BVI |

Operating Since: | 2016 |

Trading Platforms: | Proprietary app |

Maximum Leverage: | N/A |

Minimum Deposit: | N/A |

Deposit Bonus: | N/A |

Trading Assets: | Cryptos |

Free Demo Account: | Not Available |

How To Withdraw From This Company? | If you have been scammed by this broker, you can contact us to recover the funds. |

Deposits and Withdrawals

Making deposits is relatively straightforward with CoinField supporting bank transfers, credit cards, and e-wallets. However, the real trouble starts with withdrawals. Numerous users report delayed or blocked withdrawals, citing verification issues or technical difficulties as excuses. Some even claim their accounts were frozen after attempting to withdraw their funds.

Withdrawals from CoinField might be a hassle. mainly because payment sources that are subject to a chargeback are not accepted by the business. like a Mastercard and a Visa.

Crypto is the preferable alternative instead. because transfers are quick, anonymous, and essentially irrevocable. As previously noted, the withdrawal charge for Bitcoin is 0.002, which is seen to be rather expensive.

If you have lost money to companies like IPO markets, or FXTrategy; please report it to us on our Report a Scam form.

Account Types

There is no standard account type classification used by the company. Alternatively, after traders reach a higher 30-day trading volume, they can receive better fees. For instance, you have regular fees of up to $50K.

You can only receive 0% maker fees and 0.12% taker costs if $5M is traded in 30 days. Knowing that there are numerous alternative exchanges with much greater offers makes it rather depressing.

Red Flags and Warning Signs

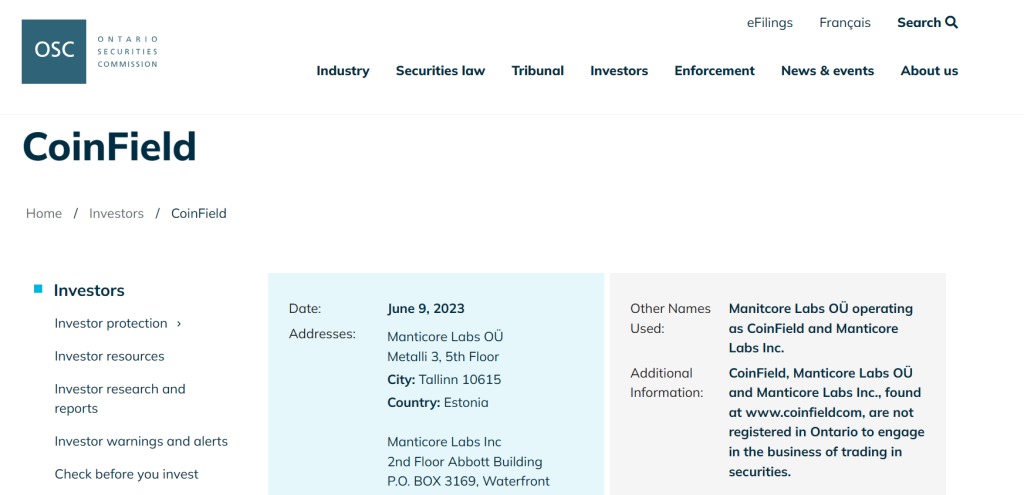

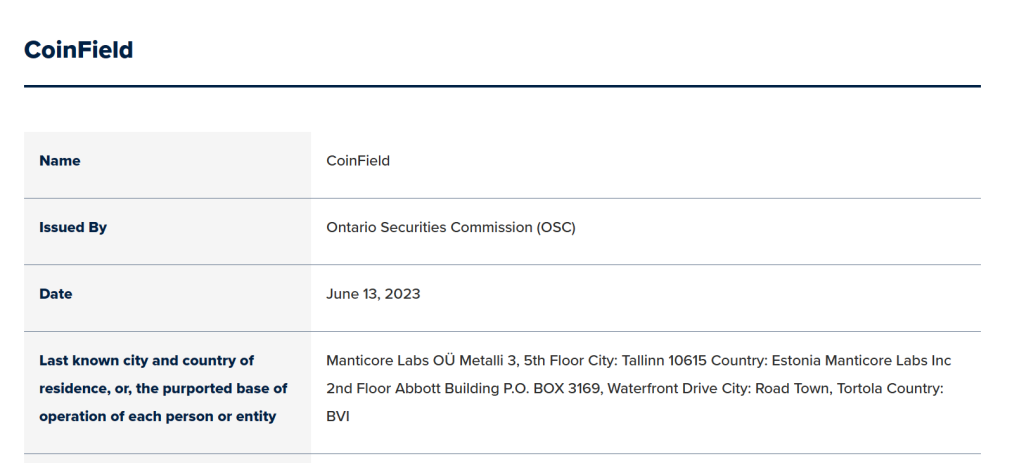

First, we need to talk about the legal history of this dubious exchange corporation, including its location and whether or not it is overseen by a respectable financial market regulator. According to the Coinfield Exchange website, Manticore Labs Inc. is the corporation that powers everything.

This organization is purportedly headquartered in Estonia and the British Virgin Islands (BVI). We searched the databases of the FSC and FI in Estonia and the BVI, but we were unable to locate Manticore Labs. This indicates that the company is not subject to any regulations.

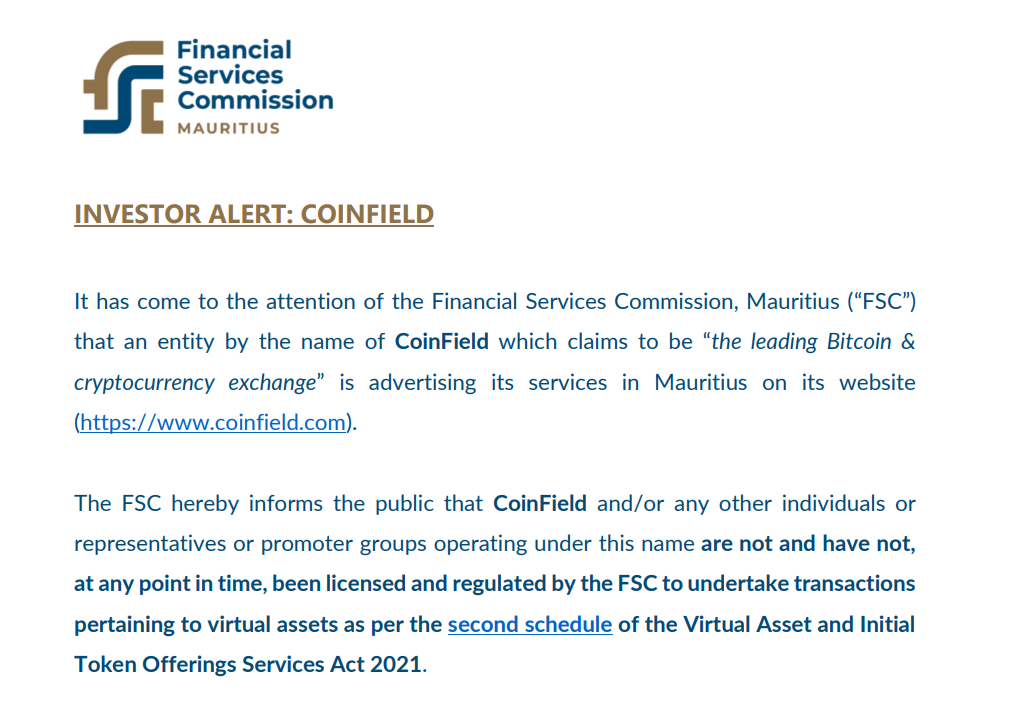

Furthermore, on June 12, 2023, the fscmauritius warned local traders about the Coinfield scam, stating that this exchange is not permitted by the authority to offer services in that area. Although scammers are typically linked to offshore domains, it says volumes when an offshore regulator issues a warning against a provider.

The fact that CoinField has been warned by two Canadian financial market authorities is the most concerning aspect of this exchange. The Canadian securities administrators issued a warning on June 13 after coinfield was detected by the Ontario Securities Commission (OSC) on June 9, 2023, as a fraudulent exchange.

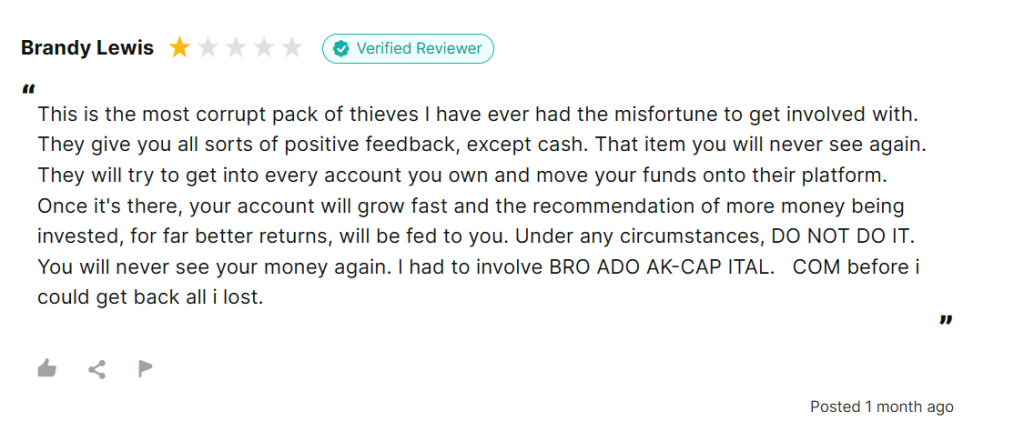

Customer Complaints and Negative Reviews

A quick search online reveals a chorus of negative experiences plaguing CoinField. Users complain about:

- Delayed or blocked withdrawals: The most common and concerning complaint, leaving users stranded with their funds locked in the platform.

- Unresponsive customer support: Ignored inquiries, unanswered emails, and nonexistent phone support add to the frustration.

- Hidden fees and charges: Surprise fees and charges eat into profits, further eroding trust in the platform.

- Technical issues and platform glitches: Users report glitches and platform errors, hindering trading and adding to the overall negative experience.

CoinField Alternative Brokers

If you’re looking for a safe and reliable platform to trade cryptocurrencies, there are far better options out there. Consider reputable and well-regulated exchanges like Binance, Coinbase, or Kraken. These platforms offer transparent fees, secure trading environments, and responsive customer support, giving you peace of mind when you invest your hard-earned money.

Got Scammed by CoinField? We Help Victims!

Unfortunately, some may already be caught in CoinField’s web. If you’ve been scammed or are having trouble withdrawing your funds, don’t lose hope. Several resources can help you recover your losses and hold the platform accountable. Consider contacting:

- The Canadian Internet Crime Complaint Centre (CICCC): They can help report online fraud and provide guidance on the next steps.

- Financial regulators: FINTRAC in Canada or your local regulatory body can investigate the platform and potential violations.

- Legal support: Consulting a lawyer specializing in cybercrime or financial fraud can offer legal advice and help pursue legal action.

Remember, staying informed and being cautious is key to avoiding crypto scams. Do your research, choose reputable platforms, and be wary of promises that seem too good to be true

One Response