Is Lenz Capital Legit or a Scam?

Investors are constantly on the lookout for reliable brokers to navigate the complex world of financial markets. However, the case of Lenz Capital raises concerns and prompts a closer look at its legitimacy. Numerous red flags and customer complaints suggest a potential scam, urging caution among potential investors.

What is Lenz Capital?

Lenz Capital claims to be a leading brokerage firm, offering a wide range of financial services. On its website, the company boasts about its cutting-edge technology, experienced team, and commitment to providing clients with a secure and seamless trading experience. However, these claims merit scrutiny, as there is a growing number of reports questioning the credibility of Lenz Capital.

Lenz Capital Details

Regulated by: | Unregulated Offshore Broker |

Is This Company Safe? | The absence of licenses makes any site unsafe! |

Known Websites: | https://herofx.co/ |

Have Warnings from: | N/A |

Registered in: | St. Lucia (alleged) |

Operating since: | 2023 |

Trading Platforms: | Web |

Maximum Leverage: | 1:100 |

Minimum Deposit: | $300 |

Deposit Bonus: | Not available |

Trading Assets: | Forex, Indices, Shares, Futures, Crypto, Metals, Energies |

Free Demo Account: | Not available |

How to Withdraw from This Company? | Payouts do not happen – better contact our legal services for help! |

Deposits and Withdrawals

One of the first areas that investors scrutinize when evaluating a broker is the ease of deposits and withdrawals. Lenz Capital’s withdrawal process, as reported by multiple users, raises serious concerns. Numerous complaints highlight delays, complicated procedures, and in some cases, complete denial of withdrawal requests. This lack of transparency and efficiency in handling withdrawals is a significant red flag.

Moreover, depositing funds into a Lenz Capital account appears straightforward, but some users have reported unexpected charges and unclear fee structures. These practices contribute to an overall sense of distrust among investors.

Account Types

Lenz Capital offers a range of account types, each supposedly tailored to meet different trading needs. These accounts vary in features such as leverage, spreads, and additional services. However, reports from users indicate that the promised benefits of higher-tier accounts are not always delivered. This inconsistency in service raises doubts about the legitimacy of Lenz Capital’s account offerings.

Red Flags and Warning Signs

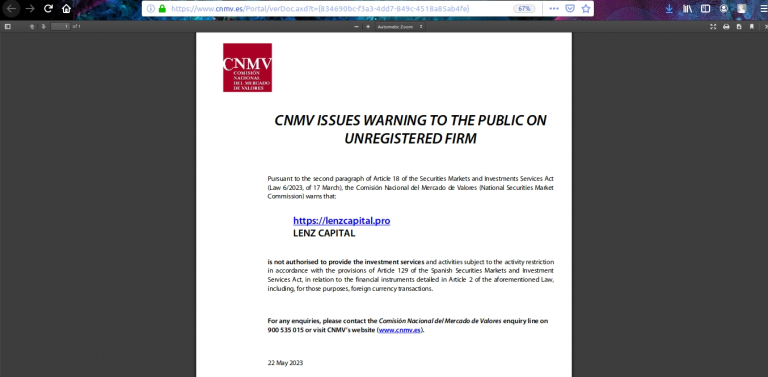

Let us begin with the National Securities Market Commission (CNMV) in Spain’s recent warning against Lenz Capital, which unequivocally declared the website to be fraudulent. Look at this:

If you examine more closely, though, you ought to be able to see that Lenz Capital is a complete fraud even in the absence of the warning. The website initially gives the impression of being anonymous; it just has a few cryptic emails and phone numbers along with no corporate name, corporate address, or corporate background of any kind. Not to mention the complete absence of any mention of a license or authorization, which ought to be more than enough to convince you that this website is not reliable.

Customer Complaints and Negative Reviews

A deeper dive into online forums and review platforms reveals a concerning pattern of customer complaints and negative reviews about Lenz Capital. Users report instances of unauthorized transactions, unexpected fees, and difficulties in closing their accounts. Many express frustration over the unresponsiveness of customer support when attempting to resolve these issues.

Got Scammed by Lenz Capital? We Help Victims!

If you have fallen victim to the practices of Lenz Capital, it’s crucial to take immediate action. Contacting regulatory authorities, such as the Financial Conduct Authority (FCA) or the Securities and Exchange Commission (SEC), can help initiate investigations into the broker’s activities. Additionally, reaching out to legal professionals specializing in financial fraud can guide potential avenues for recovering lost funds.

In conclusion, the numerous warning signs, red flags, and customer complaints associated with Lenz Capital paint a troubling picture. Investors are strongly advised to exercise caution and explore alternative, regulated brokers to safeguard their investments and financial well-being. The unregulated nature of Lenz Capital, coupled with its questionable practices, raises serious doubts about its legitimacy and reliability as a brokerage firm.

If you’ve experienced financial losses with companies like TranzactCard, HeroFX, or QxBroker, please report it using the form below.