Oro Markets is a pure scam broker. While they portray themselves as a seasoned, reliable broker, a closer look reveals troubling inconsistencies and mounting accusations of manipulation. Buckle up as we dive deep into the Oro Markets scam review, leaving no stone unturned.

What is Oro Markets?

Oro Markets presents itself as a global forex and CFD broker, established in 2013 and headquartered in Saint Vincent and the Grenadines. They boast a proprietary web-based platform and promise attractive bonuses, tight spreads, and leverage up to 1:500. However, this shiny facade crumbles under scrutiny.

Oro Markets Details:

Regulated by: | Unregulated Forex Broker |

Is This Company Safe? | No, regulators have confirmed this company is a scam! |

Known Websites: | |

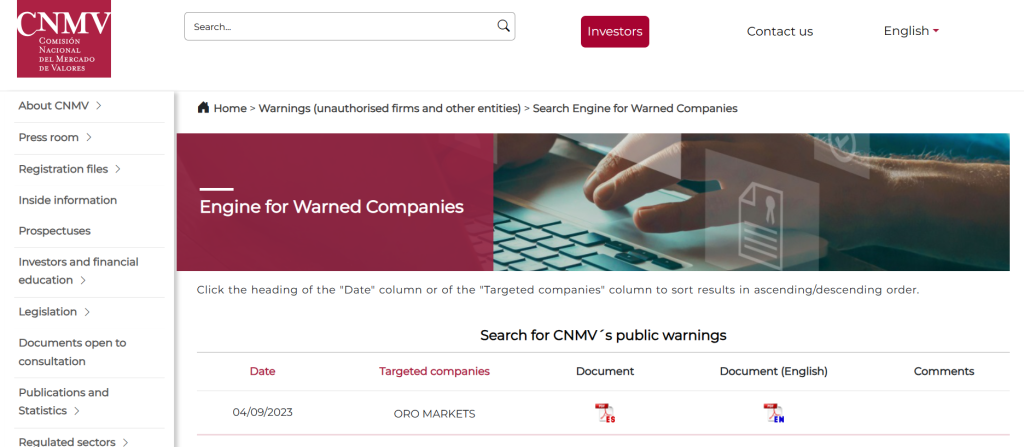

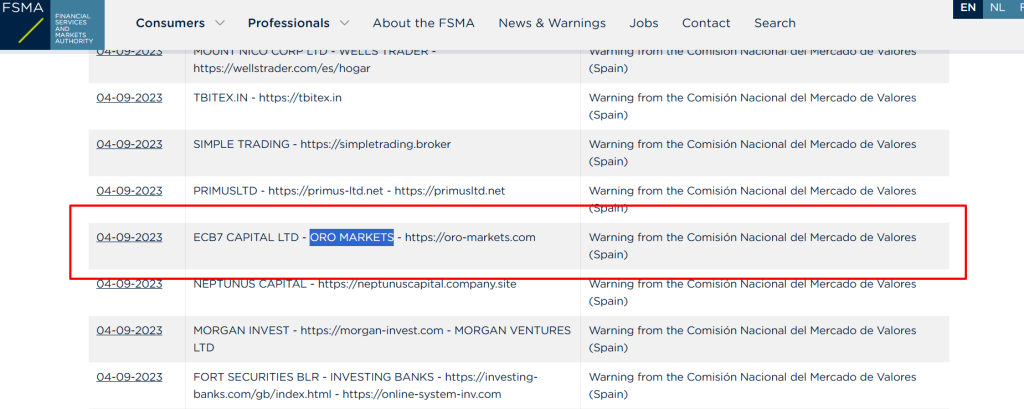

Have Warnings from: | CNMV, FSMA, CONSOB, ATVP |

Registered in: | SVG (alleged) |

Operating since: | 2023-02-08 |

Trading Platforms: | Web trader |

Maximum Leverage: | 1:500 |

Minimum Deposit: | N/A |

Deposit Bonus: | Hinted but undisclosed |

Trading Assets: | CFDs on Forex, Crypto, Metals, Indices, Commodities and Stocks |

Free Demo Account: | Not available |

How to Withdraw from This Company? | Illicit entities don’t allow payouts! Consult our legal experts for help! |

Deposits and Withdrawals:

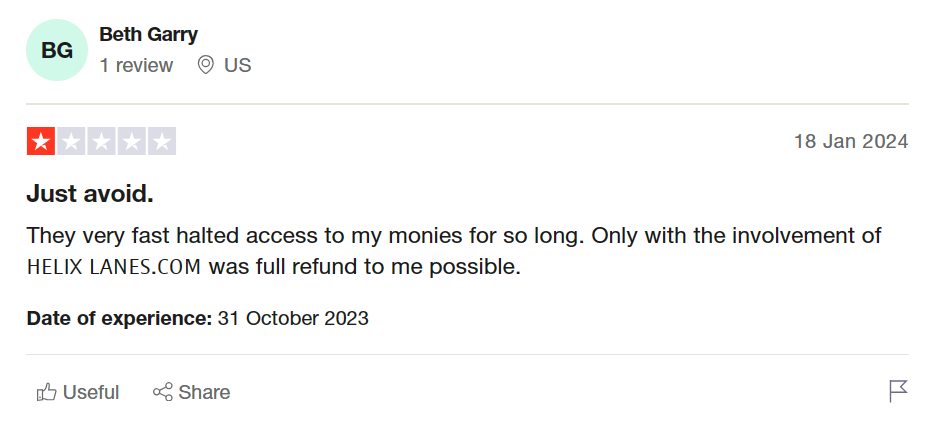

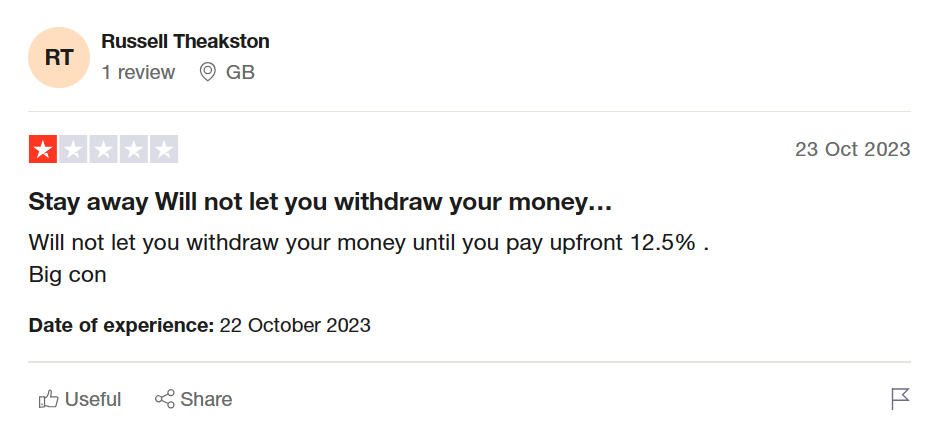

While depositing might seem seamless, withdrawing your hard-earned profits becomes an arduous, often fruitless, endeavor. Complaints of prolonged processing times, delayed withdrawals, and unresponsive customer support are rife. This raises a critical question: if your money mysteriously disappears when you try to get it back, can you really call it yours?

If you have lost money to companies like Bit Spacex, or Cronosca; please report it to us on our Report a Scam form.

Account Types:

Every Oro Markets account is advertised as being specially designed for a specific kind of trader. That’s how personalized accounts are described on the website.

Both novice and expert packages are advertised, but no specific features are mentioned. The amount of deposits needed for each kind of account is another detail that has been blatantly excluded:

- Silver

- Gold

- Platinum+

Red Flags and Warning Signs:

This broker would be in the lead if there was a competition for the most banned instances. Although ECB7 CAPITAL LTD, the parent firm, is purportedly registered in SVG, SVGFSA is unaware of this. It appears as though this company is nonexistent.

Although a US location is listed on the website, the broker is not a member of the NFA and is not a regulated company. We looked via multiple registers because Oro Markets’ website doesn’t provide any information regarding their licensing. We discovered warnings from CNMV, FSMA, CONSOB, and ATVP. For the same reason, FX Winning has also been placed on a blacklist by a few of these regulators.

Customer Complaints and Negative Reviews

A quick internet search reveals a tidal wave of negative reviews and complaints against Oro Markets. Common grievances include:

- Manipulation of the trading platform: Allegations of manipulation in favor of the broker, causing sudden losses and hindering profitable trades.

- Withdrawal problems: Reports of delayed withdrawals, unresponsive support, and ultimately, missing funds.

- Poor customer service: Ignored emails, unanswered calls, and a general lack of communication plague customer interactions.

- Hidden fees: Surprise charges and deductions eat into profits, undermining the advertised transparency.

These widespread complaints raise serious concerns about the integrity and legitimacy of Oro Markets’ operations.

Oro Markets Alternative Brokers:

Instead of risking your hard-earned money with Oro Markets, consider reputable, regulated brokers with a proven track record. Here are a few examples:

- Interactive Brokers: Renowned for their robust platform, low fees, and stringent regulations.

- eToro: Popular social trading platform with strong copy trading features and FCA regulation.

- Fidelity: Established brokerage firm offering a wide range of investment products and excellent customer service.

Got Scammed by Oro Markets? We Help Victims!

If you’ve fallen victim to Oro Markets’ alleged deceptive practices, there may be hope. Some organizations specialize in assisting victims of scam brokers, helping them recover lost funds and navigate the legal process. Remember, you’re not alone. Don’t hesitate to seek help and fight for your rights.

The bottom line? Steer clear of Oro Markets. The overwhelming evidence points to a broker shrouded in red flags and plagued by accusations of deceit. Choose a reputable, regulated broker instead, and protect your capital from the murky depths of potential scams or You Can report to us today by the below form.

2 Responses