Investing in the financial markets can be a lucrative, yet risky endeavor. Navigating this field requires utmost prudence, especially when choosing a broker to facilitate your trades. Unfortunately, the realm of forex and CFD trading is riddled with fraudulent entities attempting to prey on unsuspecting investors. Parenta Financial Services Limited, with its slick website and promises of high returns, has raised eyebrows concerning its legitimacy. So, is Parenta Financial Services Limited a scam broker or a trustworthy platform? Let’s dissect the façade and expose the red flags.

What is Parenta Financial Services Limited?

Parenta Financial Services Limited presents itself as a global forex and CFD broker, headquartered in St. Vincent and the Grenadines. They boast of offering a diverse range of trading instruments, including major currency pairs, commodities, and indices. Their website paints a picture of a user-friendly and secure trading environment, equipped with advanced charting tools and educational resources. But a closer look reveals cracks in this seemingly perfect facade.

Parenta Financial Services Limited Details: A Red Flag Catalogue

Regulated by: | Unregulated Offshore Broker |

Is This Company Safe? | The absence of licenses makes any site unsafe! |

Known Websites: | |

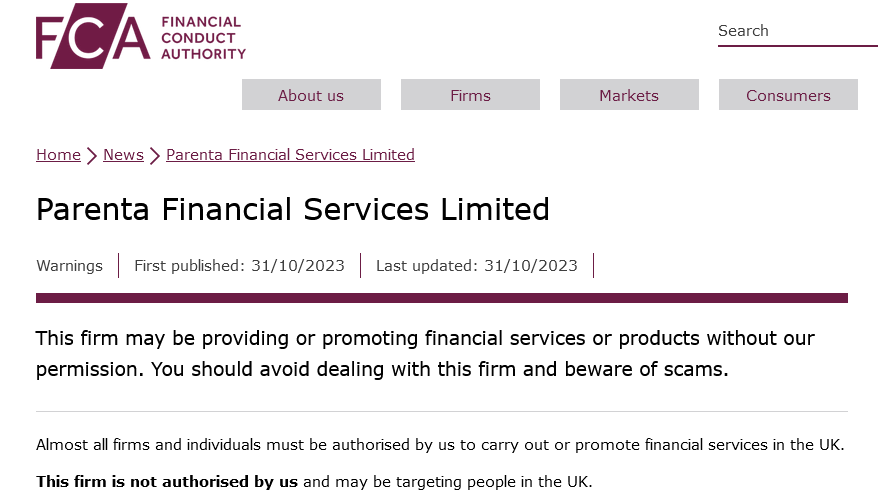

Have Warnings from: | FCA |

Registered in: | UK |

Operating since: | 2023 |

Trading Platforms: | Web |

Maximum Leverage: | 1:200 |

Minimum Deposit: | £100 |

Deposit Bonus: | Not available |

Trading Assets: | currency, crypto, indices, stocks, commodities |

Free Demo Account: | Not available |

How to Withdraw from This Company? | Payouts do not happen – better contact our legal services for help! |

Deposits and Withdrawals: A Murky Maze

Parenta Financial Services Limited boasts various deposit methods, including credit cards, wire transfers, and e-wallets. However, the withdrawal process appears shrouded in mystery. Negative reviews highlight delayed or even denied withdrawals, often citing flimsy excuses and additional verification requirements. This lack of transparency surrounding withdrawals is a significant cause for concern.

If you have lost money to companies like RaiseFX, or BraxtonWM; please report it to us on our Report a Scam form.

Account Types: Catering to Naiveté?

Parenta Financial Services Limited offers a range of account types, allegedly catering to different experience levels. However, closer examination reveals a potential strategy to exploit beginner traders. The basic accounts come with high spreads and limited leverage, discouraging profitable trading. Conversely, the premium accounts, while offering seemingly favorable conditions, might lock users in with hefty minimum deposit requirements, potentially setting them up for significant losses.

Red Flags and Warning Signs: Unmasking the Deception

London is where Parenta Financial Services says it is headquartered.

The broker must hold a Financial Conduct Authority license for this to be valid. However, there is a notice that Parenta Financial Services is not authorized while looking via the regulator’s registry.

If you plan to invest in financial instruments, you should be cautious of the numerous fraudulent brokers that can be found online. Always be sure the broker you select actually possesses the required licenses by thoroughly checking. Working with a business that is duly authorized and overseen by a regulatory body, like the Financial Conduct Authority (FCA) in the UK or the Cyprus Securities and Exchange Commission (CySEC) in the EU, has many advantages.

Customer Complaints and Negative Reviews: A Chorus of Warnings

A multitude of disgruntled users on independent platforms like Trustpilot and WikiFX paints a bleak picture of Parenta Financial Services Limited’s customer service. Complaints range from withdrawal difficulties and hidden fees to unresponsive support and manipulative trade executions. These consistent, negative narratives serve as stark warnings for potential investors.

Parenta Financial Services Limited Alternatives: Trustworthy Options Await

Fortunately, the forex and CFD trading landscape abounds with reputable and regulated brokers. Choosing a well-established platform, licensed by recognized authorities like the UK’s FCA or the US’s NFA, significantly minimizes the risk of falling victim to a scam. Additionally, prioritizing brokers with transparent fee structures, clear trading conditions, and a proven track record of customer satisfaction is crucial.

Got Scammed by Parenta Financial Services Limited? We Help Victims!

If you’ve unfortunately fallen prey to Parenta Financial Services Limited’s deceptive practices, know that you’re not alone. Several organizations and resources exist to assist victims of financial scams. Consider contacting relevant regulatory bodies, reporting the platform to fraud prevention agencies, and seeking legal counsel. Remember, the sooner you act, the higher your chances of recovering your losses.

In conclusion, Parenta Financial Services Limited exhibits all the hallmarks of a fraudulent forex and CFD broker. The lack of regulation, coupled with numerous red flags and consistent negative user experiences, should serve as a resounding warning to potential investors. Choosing a reputable and transparent broker is paramount for achieving success in the financial markets. Remember, if something seems too good to be true, it probably is. Protect yourself from scam brokers like Parenta Financial Services Limited and choose platforms that prioritize your financial security and ethical trading practices or You Can report to us today by the below from.

2 Responses