Is SmartyTrade Legit or a Scam?

Yes, SmartyTrade is a scam company. They are the brand name of another company which is registered in Marshall Island, which is an off-shore zone for scam brokers. They also have other problems with their previous traders. We will disclose the facts about this shady broker in this comprehensive review.

What is SmartyTrade?

Smartytrade is the trading name of Olma LTD, an offshore trading platform purportedly based in the Marshall Islands. A straightforward, highly leveraged web-based trading platform is provided by the broker’s website.

As we previously indicated, the maximum leverage that Smartytrade offers is 1:100, which is far more than the legal caps for retail clients in North America (1:50) and Europe (1:30). High leverage is rather dangerous since it might increase both possible gains and losses.

Spreads and commissions, or trading expenses, were not published; nevertheless, the FAQ section states that the site takes a 15% commission on winnings from a 50/50 binary options trade.

Additionally, the broker gives out bonuses to clients—bonuses that are, incidentally, illegal in Europe. There are conditions tied to these bothersome incentives, though.

SmartyTrade Details

Regulated by: | Unregulated Offshore Broker |

Is This Company Safe? | No |

Known Websites: | |

Have Warnings from: | N/A |

Registered in: | Marshall Islands |

Operating since: | 2020-12-16 |

Trading Platforms: | WebTrader |

Maximum Leverage: | 1:100 |

Minimum Deposit: | 50 USD |

Deposit Bonus: | 50%-150% |

Trading Assets: | Forex, CFDs, Binary Options |

Free Demo Account: | Available After Deposit |

How to Withdraw from This Company? | Since this company is unlikely to return your money – contact your bank or financial regulator, or simply reach out to us for professional assistance in recovering your funds. |

Deposits and Withdrawals

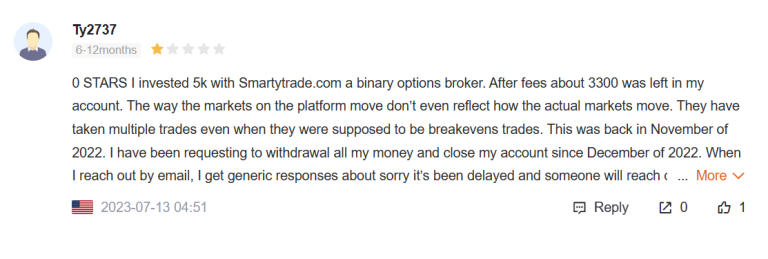

While SmartyTrade claims to offer seamless deposit and withdrawal options, user testimonials paint a different picture. Stories abound of delayed withdrawals, unresponsive customer support, and exorbitant fees. This lack of transparency regarding financial transactions is a major red flag for any potential investor.

Account Types

SmartyTrade offers three account tiers with varying benefits and minimum deposits. However, closer inspection reveals that these benefits seem designed to entice larger investments rather than offer genuine trading advantages. Moreover, the lack of regulation raises concerns about the security of your funds even in the highest account tier.

Account Type | Bronze | Silver | Gold |

Minimum Deposit | 250 USD | N/A | N/A |

Maximum Leverage | 1:100 | 1:100 | 1:100 |

Deposit Bonus | 50% | 100% | 150% |

Red Flags and Warning Signs

For the simple reason that the local regulator in the Marshall Islands does not enforce financial market regulations to the same level as reputable onshore authorities, the country is not regarded as a safe jurisdiction.

As a result, an entity that is registered there cannot be said to be appropriately controlled. For example, in the event of insolvency or questionable losses, offshore brokers are not required to reimburse their clients. They are also not obliged to keep traders’ money separate in a separate bank account.

Contrary to the information on the website, some additional Smartytrade reviews we read indicate that this trading service is headquartered in Canada. We advise against trading on this platform due to all of these factors.

Customer Complaints and Negative Reviews

A quick search online reveals a treasure trove of negative reviews for SmartyTrade. Users complain about:

- Difficulty withdrawing funds: Many report facing hurdles and delays when attempting to withdraw their earnings, raising concerns about fund security.

- Unresponsive customer support: Attempts to contact customer support for assistance are often met with silence or unhelpful responses, leaving users feeling stranded.

- Hidden fees: Be wary of seemingly transparent fee structures. Users have reported unexpected charges and deductions, eroding their profits.

Got Scammed by SmartyTrade? We Help Victims!

If you’ve unfortunately fallen victim to SmartyTrade’s deceptive practices, there are resources available to help.

- Report your case to the relevant financial authorities: Depending on your location, report the fraudulent activity to the appropriate regulatory body.

- Seek legal counsel: Consider consulting a lawyer specializing in financial fraud to explore your legal options.

- Share your experience online: Publicly sharing your story on review platforms and forums can warn others and prevent future victims.

Remember, it’s never too late to take action and protect your financial well-being. Prioritize safety and choose reputable, regulated brokers for your trading endeavors. Don’t let the allure of quick profits overshadow the importance of financial security.

If you’ve experienced financial losses with companies like WealthPro365, Exorays, or Cylwex, please report it using the form below.