Is Ufina Capital Legit or a Scam?

In the vast and often treacherous landscape of online trading, distinguishing between legitimate brokers and fraudulent entities is crucial. One such entity that has raised eyebrows and drawn attention for all the wrong reasons is Ufina Capital. The pressing question on the minds of many potential investors is whether Ufina Capital is a legitimate platform or a scam waiting to unfold.

What is Ufina Capital?

Ufina Capital presents itself as an online trading platform offering a variety of financial instruments, including forex, commodities, indices, and cryptocurrencies. Like many brokers in the industry, Ufina Capital claims to provide cutting-edge technology, comprehensive educational resources, and personalized customer support to facilitate seamless trading experiences for its clients.

Ufina Capital Details

Before delving into the intricacies of Ufina Capital, let’s take a closer look at some key details about the platform:

Regulated by: | Unregulated Scam Broker |

Is This Company Safe? | No |

Known Websites: | |

Have Warnings from: | FCA |

Registered in: | UK (allegedly) |

Operating since: | 2023-08-30 |

Trading Platforms: | MT5 |

Maximum Leverage: | 1:300 |

Minimum Deposit: | 250 USD |

Welcome Bonus: | 5%-20% |

Trading Assets: | Forex, Indices, Stocks, Cryptocurrencies |

Free Demo Account: | Unavailable |

How to Withdraw from This Company? | Since this company is unlikely to return your money – contact your bank or financial regulator, or simply reach out to us for professional assistance in recovering your funds. |

Deposits and Withdrawals

One critical aspect that often serves as a litmus test for the legitimacy of a broker is its deposit and withdrawal processes. Reports from traders suggest that Ufina Capital’s deposit methods are relatively standard, encompassing credit/debit cards, bank transfers, and select e-wallets. However, the withdrawal process has raised red flags.

Numerous complaints have surfaced regarding delayed or denied withdrawals. Traders have reported difficulties accessing their funds, leading to frustration and mistrust. Such issues not only hinder the trading experience but also cast doubt on the broker’s credibility.

Account Types

Ufina Capital offers various account types, each supposedly tailored to meet the diverse needs of traders. These may include basic accounts for beginners and advanced accounts for seasoned investors.

Account Type | Elementary | Intermediate | Advanced | Professional |

Minimum Deposit | 250 USD | 1,000 USD | 5,000 USD | 25,000 USD |

Maximum Leverage | 1:100 | 1:100 | 1:200 | 1:300 |

Spreads | Floating | Floating | Floating | Floating |

Welcome Bonus | 5% | 10% | 15% | 20% |

Red Flags and Warning Signs

According to the legal documents, the company’s headquarters are in the United Kingdom. But there is not a shred of evidence to back up that assertion. Regarding Ufina Capital’s warnings, we discovered that this business was marked as unlawful by the Financial Conduct Authority (FCA) of the United Kingdom.

You also won’t be covered by the Financial Services Compensation Scheme (FSCS) if something goes wrong if you trade on this platform. This implies that if the company fails, it is improbable that you would receive your money back,” the FCA notes. The broker cannot be trusted as a result.

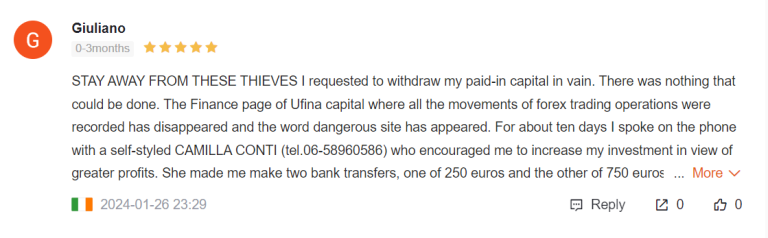

Customer Complaints and Negative Reviews

A quick online search reveals a plethora of customer complaints and negative reviews about Ufina Capital. Traders have reported issues ranging from poor customer service and technical glitches on the platform to difficulties in withdrawing funds. Such consistent negative feedback raises serious concerns about the broker’s integrity and ability to deliver on its promises.

Ufina Capital Alternative Brokers

For those seeking a more secure and trustworthy trading experience, considering alternative brokers is a prudent move. Reputable brokers with a proven track record of regulatory compliance and positive customer feedback provide a safer haven for traders looking to navigate the financial markets.

Got Scammed by Ufina Capital? We Help Victims!

If you find yourself falling victim to the deceptive practices of Ufina Capital, there are steps you can take to seek recourse. Reach out to regulatory authorities, file a complaint with relevant financial watchdogs, and consider consulting legal advice. Additionally, sharing your experience on online forums and review platforms can help warn others and contribute to the exposure of fraudulent activities.

In conclusion, the question of whether Ufina Capital is legit or a scam remains unanswered, but the numerous red flags, customer complaints, and negative reviews paint a concerning picture. Traders are advised to exercise utmost caution and explore alternative, reputable brokers to safeguard their investments and financial well-being.