Is InvestusPro Legit or a Scam?

Investors around the world are constantly on the lookout for reliable brokers to engage in financial markets. However, not all brokers are created equal, and some may pose serious risks to your investments. In this review, we scrutinize InvestusPro to determine whether it is a legitimate platform or a potential scam.

What is InvestusPro?

InvestusPro positions itself as an online trading platform that offers a range of financial instruments, promising lucrative opportunities to traders. The platform claims to provide a user-friendly interface and advanced tools for both novice and experienced traders. However, as we delve deeper into its details, red flags start to emerge.

InvestusPro Details

Regulated by: | Unregulated Broker |

Is This Company Safe? | InvestusPro is an unlicensed brokerage, it is not safe for investing! |

Known Websites: | InvestusPro.com |

Have Warnings from: | N/A |

Registered in: | UK (alleged) |

Operating since: | February 2023 |

Trading Platforms: | InvestusProwebtrader platform |

Maximum Leverage: | 1:400 |

Minimum Deposit: | €250 |

Deposit Bonus: | Up to 70% |

Trading Assets: | Forex, Cryptocurrencies, Stocks, Indices, Commodities |

Free Demo Account: | N/A |

How to Withdraw from This Company? | Contact our legal experts for help in charging back your funds. |

Deposits and Withdrawals

One significant aspect that raises concerns about InvestusPro is its deposit and withdrawal process. The minimum deposit requirement of $250 is fairly standard in the industry, but the withdrawal fees are not transparent. Some traders have reported unexpected deductions, raising suspicions about the platform’s credibility. Investors must have clarity on fees to make informed decisions, and the lack of transparency here is a major red flag.

Account Types

At InvestusPro, almost all account types entail communication in some way with a “personal account manager.” These are the individuals we refer to as Boiler Room Agents. The accounts are rather expensive, and traders who deposit larger amounts are said to receive better benefits. Greater bonuses are one of these benefits, for example.

The ImvestusPro Account Types are as follows:

- Basic – €250, leverage 1:200

- Silver – €2 250, leverage 1:200

- Gold – €10 000, leverage 1:300

- Platinum – €25 000, leverage 1:400

Red Flags and Warning Signs

InvestusPro describes itself as a multinational company with two regional offices. One of them is located at House, Third Floor, 66, Welbeck, 67 Wells St. in London, UK. The other is said to be located at 100 Queens Quay E, Suite 1600, Toronto, Canada. It’s evident from a cursory Google Maps search that neither of these addresses is real. Because they are the posting addresses for entirely unrelated businesses that are not associated with InvestusPro, we are aware of this.

Brokerages are subject to various regulations imposed by financial regulators in different regions. An FCA license from the UK and a New SRO license from Canada are required for a broker, as InvestusPro purports to be. They wouldn’t be allowed to carry out any other kind of business.

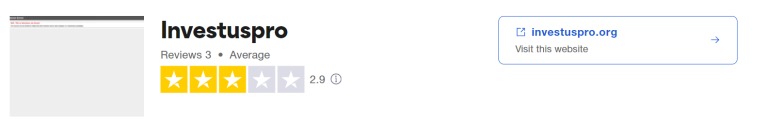

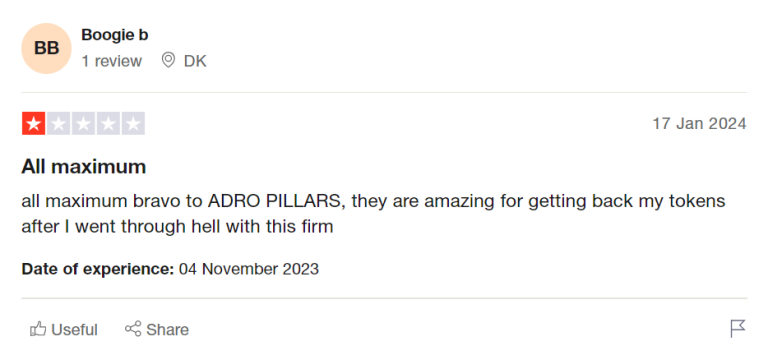

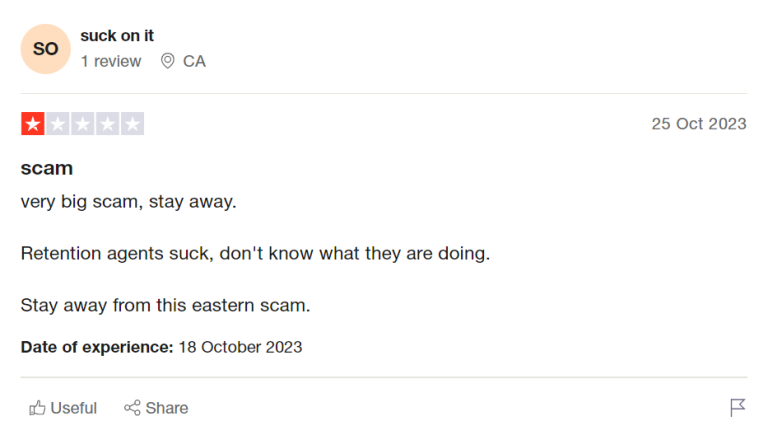

Customer Complaints and Negative Reviews

A quick search reveals a multitude of customer complaints and negative reviews about InvestusPro. Traders report difficulties in withdrawing funds, unexpected charges, and unresponsive customer support. These consistent grievances raise serious doubts about the broker’s reliability and integrity.

https://youtu.be/tPBqXmiGAPA

Got Scammed by InvestusPro? We Help Victims!

If you find yourself a victim of InvestusPro’s questionable practices, it’s crucial to take immediate action. Contact your financial institution to report the issue and seek their guidance on recovering any lost funds. Additionally, reach out to your local regulatory authority to file a complaint against the fraudulent activities of InvestusPro. Sharing your experience can also help prevent others from falling victim to similar scams.

In conclusion, the numerous red flags, customer complaints, and lack of transparency surrounding InvestusPro strongly suggest that it may be a scam broker. Traders should exercise extreme caution and consider alternative, regulated platforms to safeguard their investments and financial well-being.

If you’ve experienced financial losses with companies like GalaxyEx, HeroFX, or QxBroker, please report it using the form below.