Is Vivo Holding Legit or a Scam?

Unmasking the truth about Vivo Holding can be trickier than navigating a labyrinth. Positive online reviews tout them as a “cutting-edge platform” and highlight rapid withdrawals, professional service, and even “consistent income streams.” However, scratch beneath the surface, and a different picture emerges – one riddled with red flags, customer complaints, and a distinct lack of legitimate regulation.

What is Vivo Holding?

Vivo Holding presents itself as a “reliable and trustworthy” trading platform offering access to forex, commodities, and CFDs. They boast a sleek interface, responsive customer support, and low minimum deposit requirements, seemingly ideal for both seasoned investors and newbies alike.

Vivo Holding Details

But before falling victim to their alluring facade, let’s dissect the details:

Regulated by: | No regulations |

Is This Company Safe? | No |

Known Websites: | Vivoholding.io |

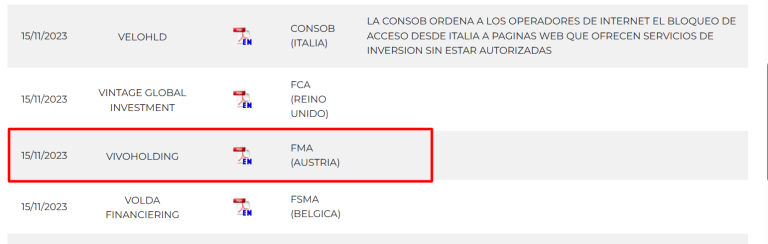

Have Warnings from: | FMA, FSMA, CNMV |

Registered in: | Netherlands (allegedly) |

Operating since: | 2023 |

Trading Platforms: | Web trader |

Maximum Leverage: | 1:2 for UST pairs / 1:4 for others |

Minimum Deposit: | 250 EUR or GBP |

Deposit Bonus: | N/A |

Trading Assets: | Forex, Indices, Commodities, Stocks |

Free Demo Account: | No |

How to Withdraw from This Company? | If you were expecting to get a withdrawal from a company that is on a warning list of three authorities, you better start the chargeback today! For detailed advice, we offer you the first consultation for free. Get in touch today! |

Deposits and Withdrawals

While Vivo Holding advertises swift withdrawals, user testimonials paint a far bleaker picture. Stories abound of delayed payouts, requests being ignored, and accounts mysteriously frozen after attempting withdrawals. This raises serious concerns about the platform’s financial stability and potential manipulation of user funds.

Account Types

The four account tiers, ranging from “Basic” to “VIP,” promise progressively tighter spreads and additional benefits. However, critics argue that these tiers are simply a marketing ploy to entice higher deposits while obscuring the underlying lack of transparency and potential hidden fees.

Red Flags and Warning Signs

This broker has received several warnings from different reputable authorities such as FSMA, CNMV, etc.

Customer Complaints and Negative Reviews

Vivo Holding’s online reputation is riddled with negativity. Users report difficulties withdrawing funds, being pressured into depositing more money, and experiencing technical glitches that mysteriously favor the platform. These consistent complaints paint a damning picture of a broker operating with little regard for user interests or ethical trading practices.

Got Scammed by Vivo Holding? We Help Victims!

If you’ve fallen victim to Vivo Holding’s deceptive practices, you’re not alone. Several organizations specialize in assisting victims of online scams and can help you recover your lost funds. Reach out to reputable financial regulators, consumer protection agencies, or independent fraud recovery specialists for expert guidance and potential assistance in reclaiming your losses.

Remember, a healthy dose of skepticism is your best defense against online scams. Don’t be seduced by unrealistic promises or slick platforms. Conduct thorough research, prioritize regulatory compliance, and choose only established, reputable brokers for your online trading endeavors.

If you’ve experienced financial losses with companies like BitGamo, RiveGarde, or Cylwex, please report it using the form below.