The perfect answer is: that YorkPro is a pure scam. While the broker boasts shiny features and promises of financial freedom, a closer look reveals cracks in the facade, whispering tales of red flags and dissatisfied customers. Before diving headfirst into this murky pool, let’s shed some light on what YorkPro is and what lies beneath the surface.

What is YorkPro?

YorkPro presents itself as a global online trading platform, offering a diverse range of instruments including forex, CFDs, cryptocurrencies, and precious metals. They tout a user-friendly interface, competitive spreads, and educational resources to empower traders of all levels. However, beneath this alluring veneer, whispers of shady practices and questionable regulations begin to surface.

YorkPro Details:

Regulated by: | Unregulated Offshore Broker |

Is This Company Safe? | The absence of licenses makes any site unsafe! |

Known Websites: | |

Have Warnings from: | N/A |

Registered in: | Estonia |

Operating since: | 2022-01-05 |

Trading Platforms: | N/A |

Maximum Leverage: | 1:500 |

Minimum Deposit: | N/A |

Deposit Bonus: | Not available |

Trading Assets: | Forex, Indices, Shares, Futures, Crypto, Metals, Energies |

Free Demo Account: | Not available |

How to Withdraw from This Company? | Payouts do not happen – better contact our legal services for help! |

Deposits and Withdrawals:

For credit card and wire transfers, the minimum withdrawal amount is $100/GBP/EUR. The cost of these withdrawals is USD 50, GBP 50, or EUR. There is a 0.0001 BTC fee for cryptocurrency deposits and withdrawals. As of the time this article was written, this sum is equivalent to about USD 6,2.

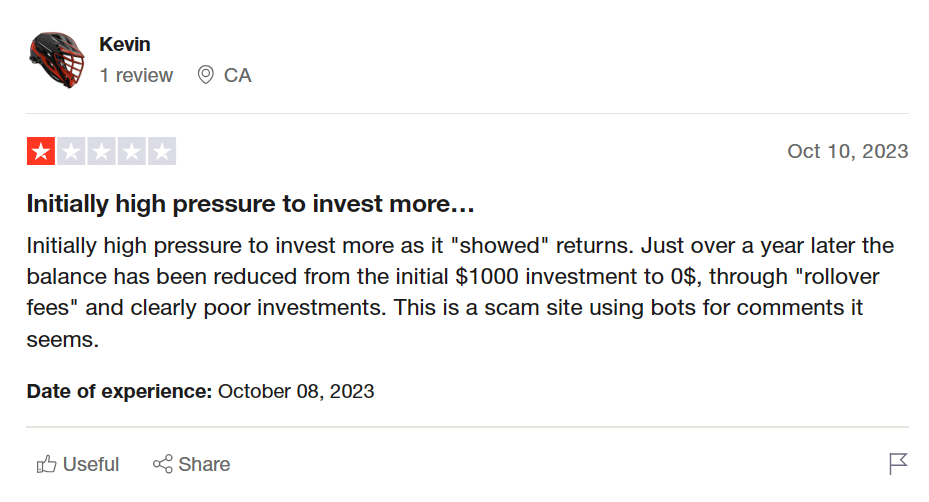

Additionally, Yorkpro says that rollover fees on open contracts range from 0.05% to 0.249%, with an extra 5% charged if the client uses the exchange facility.

If you have lost money to companies like Bitexfy, or Prime Forexlyfe; please report it to us on our Report a Scam form.

Account Types

YorkPro offers three account types: Silver, Gold, and Platinum. Each tier unlocks additional features like tighter spreads and dedicated account managers. However, the significant differences in deposit requirements and benefits raise concerns about preferential treatment for larger investors, potentially disadvantaging smaller traders.

Red Flags and Warning Signs:

Yorkpro has made an effort to imply that they are based in one of the major financial centers of the globe by including a UK contact address on their website. In addition, it is stated in the Terms and Conditions that Estonian law will govern all interactions with clients.

A broker must fulfill several requirements and be subject to strict regulations in order to be licensed to operate in the UK or in a member state of the EU, such as Estonia. Nevertheless, no company bearing that name is authorized to conduct brokerage activity in these jurisdictions, according to the records of the Estonian Financial Supervision Authority and the UK’s Financial Conduct Authority.

Customer Complaints and Negative Reviews:

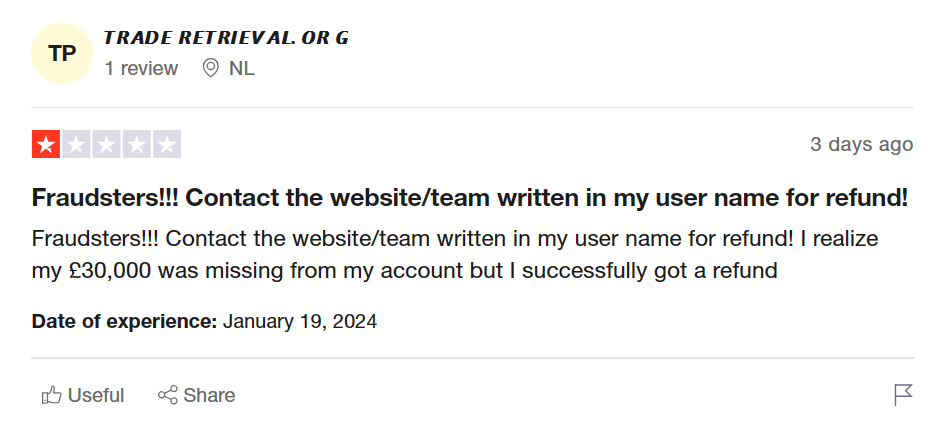

A plethora of negative reviews on Trustpilot and other platforms reveal a common theme: customer dissatisfaction. Users complain about:

- Withdrawal issues: Delays, unexplained fees, and even denied withdrawal requests plague the platform, raising concerns about fund security.

- Poor customer support: Unresponsive agents, unhelpful communication, and a lack of resolution for raised issues further erode trust.

- Suspicious trading activity: Some users report unexplained spikes in spreads and discrepancies in order execution, raising doubts about fair market practices.

YorkPro Alternative Brokers:

Before venturing into the murky waters of YorkPro, consider reputable and licensed alternatives such as:

- IG: A well-established broker with a strong reputation and Tier-1 licenses from major regulators.

- Interactive Brokers: A popular choice for advanced traders, offering a wide range of instruments and a powerful trading platform.

- TD Ameritrade: A user-friendly platform with excellent educational resources, suitable for beginners and experienced traders alike.

Got Scammed by YorkPro? We Help Victims!

If you’ve fallen victim to YorkPro’s questionable practices, you’re not alone. Resources like the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC) offer assistance to victims of financial scams. Additionally, online communities dedicated to exposing financial fraud can provide support and guidance.

Remember, the allure of quick gains often masks the dangers of unregulated platforms. Before entrusting your hard-earned money to any broker, prioritize safety and transparency. Choose a reputable, licensed broker with a proven track record of customer satisfaction, and trade with caution, always aware of the inherent risks involved in financial markets.

If you want to get quick help, you can contact us. You will get a free consultation and recovery service recommendations to get help in recovering the lost funds or You Can report to us today by the below form.

2 Responses