Day trading is one of the viral strategies on the cryptocurrency market due to its high volatility. Every day, people earn from hundreds to thousands of dollars through day trading cryptocurrency. Normally, traditional buy-and-hold investors focus more on the long-term profitability of a company. On the other hand, day traders aim to take advantage of immediate profit-making opportunities from any company.

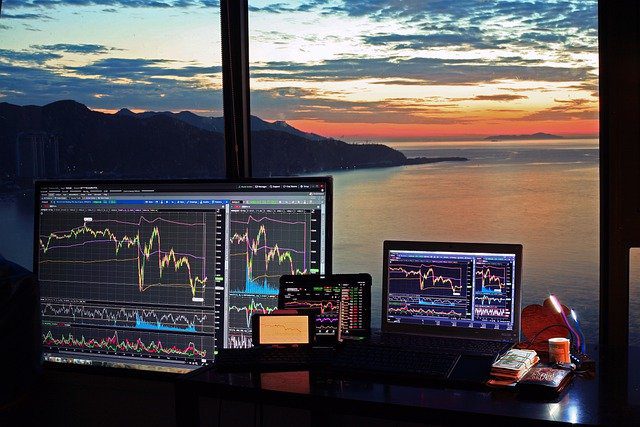

Traders who are successful mostly rely on a number of resources and tools. Stock screening or trading solution software is the main tool to analyze the market. These tools help in capitalizing on the short-time price movement of bonds, stock, and other currencies.

Although you can have a high profit, the process to acquire the profit is very difficult and involves various risks. But that didn’t stop people from pursuing day trading in the crypto markets. For day trading in the crypto market, you don’t need a subscription to a brokerage margin account. This allows new traders to access the market and start trading easily.

But it is essential to learn all the necessary information and rules so that you can start day trading without facing losses. Also, you have to know How to identify fake Cryptocurrency. In this article, we will describe the whole process step by step to make you understand how the day trading cryptocurenccy works.

1. Choosing a platform for trading

If you want to start day trading then the first thing to do is choose a platform. For example, US-based traders have access to only domestically regulated crypto-trading platforms.

Asset liquidity, exchange liquidity, and fees are the main priorities in the list of a trader for choosing the right platform. As the crypto markets are extremely volatile, the value of digital assets can fluctuate drastically. If you want to maximize the profits then you need to make your moves very fast.

It is not guaranteed that the first option will be the best option for conducting crypto trading. The diverse ranges of many crypto exchanges can be quite overwhelming when trading.

For that, you have to consider some major things for choosing the right trading platform. These are-

- Active years- If the exchange has been running for a long time then it is a sign of stability and credibility.

- Available cryptos- It is important to know what types of cryptocurrencies are valuable on that platform. Day traders who are interested in altcoins have more options from the smaller exchanges But the options are lower in bigger exchange

- Charge- It is important to compare how much of the transaction fees are from other platforms. These charge fees may vary depending on the transaction value.

- Methods of deposit- The user needs to finance their exchange account with some practical methods similar to brokerage. The allowance for bank transfers is given by many exchanges. But few allow for PayPal transfer, gift card transfers, or credit card funding.

- Honest reviews- User feedback is a good method to determine how legit and productive a day trading crypto platform is.

- Liquidity- Exchange liquidity determines the speed and ease of access an exchange has in converting one asset to another without affecting the price itself. The best crypto exchanges are normally highly liquid. This means you can buy or sell the assets immediately with a minimum difference between the ask and bid price.

2. Choosing your investment wisely

If you are set on choosing the platform, the next step is to pick where to invest your money. Market volatility is a common phenomenon for crypto day traders. Even though the market always scares away the buy-and-hold investors for the chaos, it still opens opportunities to make profits for the day traders.

Volatility and liquidity are the two common factors that day traders face every day in the crypto market. Reading the charts won’t make you a successful day trader. You need to learn more about what blockchain does along with its network size, governance, and protocols.

If you don’t want to face a big loss then it is important not to put all eggs in the same basket. You can try and invest in the top 15 to 20 coins by market cap. Also researching crypto coins can give a better understanding of which to invest.

When choosing what to invest you have to consider some other elements too. These are-

- Asset Liquidity- To measure how easily an asset can convert into cash without affecting its price is done through asset liquidity. When the trader executes the trade and exchange fulfills the order, the price of the crypto asset is changed.

- Volatility- Understanding and accounting for volatility can give a day trader a huge head start. The unpredictable crypto price movement determines the volatility of the market. News cycles, research reports, and economic data are the factors that affect volatility.

- Trading volume- The total number of cryptocurrencies traders over a fixed period of time is known as trading volume. A crypto’s trading volume determines the measurement of the overall market interest. It is important to note that crypto with high trading volume tends to have higher liquidity. If you look at an asset’s trading volume carefully then you can determine when to sell at a higher price.

3. Choosing a good trading strategy

Day traders follow various techniques to maximize the profit from day trading. And to maximize the profit a day trader must have well-laid plans and plot a winning strategy backed by research.

Here are some of the techniques to understand when to enter and exit your position on the day trading cryptocurrency platform –

- Arbitrage- When a trader buys a cryptocurrency from one exchange and makes a profit by selling to another exchange at a higher price, the whole procedure is known as arbitrage. The cryptocurrency pairs open the gate for arbitrage opportunities. The price of crypto pairs consisting of a lesser-known altcoin and bitcoin may vary from one exchange to another. The arbitrageurs take advantage of the price difference and gain profit.

- Bot trading- A trading bot is nothing but an automated software tool that is used to increase profits and reduce losses. Investors use this tool to buy and sell financial instruments when predefined conditions are met. These trading bots can smartly assess the price movements, exchange fees, and right opportunities to make maximum profit on trades.

- Range Trading- Range trading is a good method to identify when the asset’s price will be at the lowest and highest point. Online screeners are used by crypto day traders to find the right timing for crypto assets to trade. Using range trading reduces the risk of losing. That is why this is favored by many crypto day traders.

- Scalping- Because of the ease of automation for bots, potential profitability, and low risks, it is widely favored by day traders. This trading strategy is recognized for its fastest turnaround. The scalpers use the advantage and leverage a large amount of liquidity and seize on small price movements. This strategy involves buying and selling bitcoin or altcoins in a few hours and cast out with a small percentage gain by the end of the day.

- Technical analysis – Technical analysis is basically the study of financial data for finding the statistical trend in the markets. The financial data includes historical price and volume data points. Using the historical data, the technical analysts can apply their strategy to any market or security they want. Technical analysis is used in crypto by evaluating the past performance which dictates future gains or losses. Relative strength index (RSI) is widely approved by various traders who support technical analysis. RSI determines whether and assets are overbought(at a high price) or oversold( at a low price )

Major pros and cons of day trading cryptocurrency

Any investment in the crypto market is with high risk and that is why there is a high reward in return. Crypto may be the trending topic in the virtual world but there is a chance of crypto investments getting evaporated.

Traders should always keep themself updated about the upcoming rules and regulations to maximize profit. And before coming into this sector, new entrants should know the pros and cons in advance.

Pros

- Day trading is easily possible by anyone if he or she has the access to a crypto exchange. The only thing you need to do is verify your identity and fund your exchange account. Fortunately, there is no barrier to entry for retail investors or research and interaction with the crypto markets.

- Crypto markets are always open every day 24/7 all year around. Traders can buy and sell as much they want since the crypto market does not close. The benefit of this is that you can trade when it suits you as it is open 24/7.

- Cryptocurrencies and blockchain technology are decentralized systems that are designed for anonymous users. This benefits the user as he or she can process payments without an intermediary. And due to the absence of government taxes and fees, makes the cost of transacting crypto very cheap.

Cons

- As the platform is accessible by anyone, new and inexperienced traders can face huge losses even though they might get profits at first.

- The 24/7 market can be a double-edged sword. Since it is always open, there are fewer patterns in the day where the profits are predictable. That is why crypto day traders always found themselves glued to the charts for looking at the right time to trade. As the trend pattern gets harder to find, the quick day trading session can also turn into night trading sessions

- Most of the day trading exchanges for cryptocurrencies are unregulated.

- If you are inexperienced then you can fall victim easily to pump and dump schemes or wash scales.

The financial takeaway of crypto day trading

Crypto day trading is a high-risk strategy since the crypto market is very volatile. It involves the frequent purchase of cryptos for acquiring short-time profit. Anyone who is interested in day trading crypto must have a proper plan to execute on trading. It is important to have a detailed day trading strategy and stick to the entry and exit points.

One should be sorted about the fact that the large majority of day traders lose profits. It is essential to focus solely on trades, sticking to a fully-fledged strategy, and measuring profits & losses. These essential factors are what will separate crypto day trading from gambling.

Some day trading FAQ

1. How can you trade cryptocurrency?

For trading in the cryptocurrency market, the most important part is to have a rule-based strategy and a structured approach. You have to absorb the fact that you won’t be able to make money every day, therefore a foolproof strategy is essential for day trading cryptocurrency.

2. How do crypto-traders handle the market?

It is seen that most of the crypto traders handle the market from a gambling paradigm. They do not follow the quantified method. It has been observed that 90% of all traders lose 90% of their investment within the 90 days of trading,

3. What is the ideal holding time to hold profits?

It is best advised to hold the profits for the first hours after your trade gets triggered. If you hold the trader longer then the result will end with a lower success rate. So the trimming is very important in the day trading cryptocurrency market.

3 Responses